Authors

Summary

We study a novel large dimensional approximate factor model with regime changes in the loadings driven by a latent first order Markov process. By exploiting the equivalent linear representation of the model, we first recover the latent factors by means of Principal Component Analysis. We then cast the model in state-space form, and we estimate loadings and transition probabilities through an EM algorithm based on a modified version of the Baum-Lindgren-Hamilton-Kim filter and smoother that makes use of the factors previously estimated. Our approach is appealing as it provides closed form expressions for all estimators. More importantly, it does not require knowledge of the true number of factors. We derive the theoretical properties of the proposed estimation procedure, and we show their good finite sample performance through a comprehensive set of Monte Carlo experiments. The empirical usefulness of our approach is illustrated through three applications to large U.S. datasets of stock returns, macroeconomic variables, and inflation indexes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

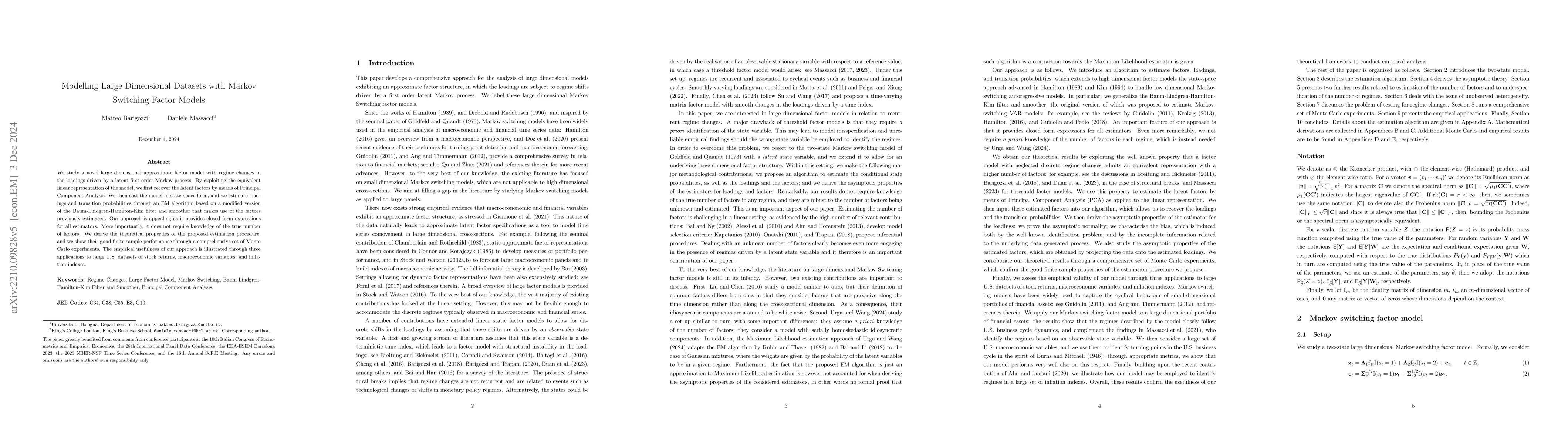

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThree-Dimensional stochastic Navier-Stokes equations with Markov switching

Padmanabhan Sundar, Po-Han Hsu

| Title | Authors | Year | Actions |

|---|

Comments (0)