Summary

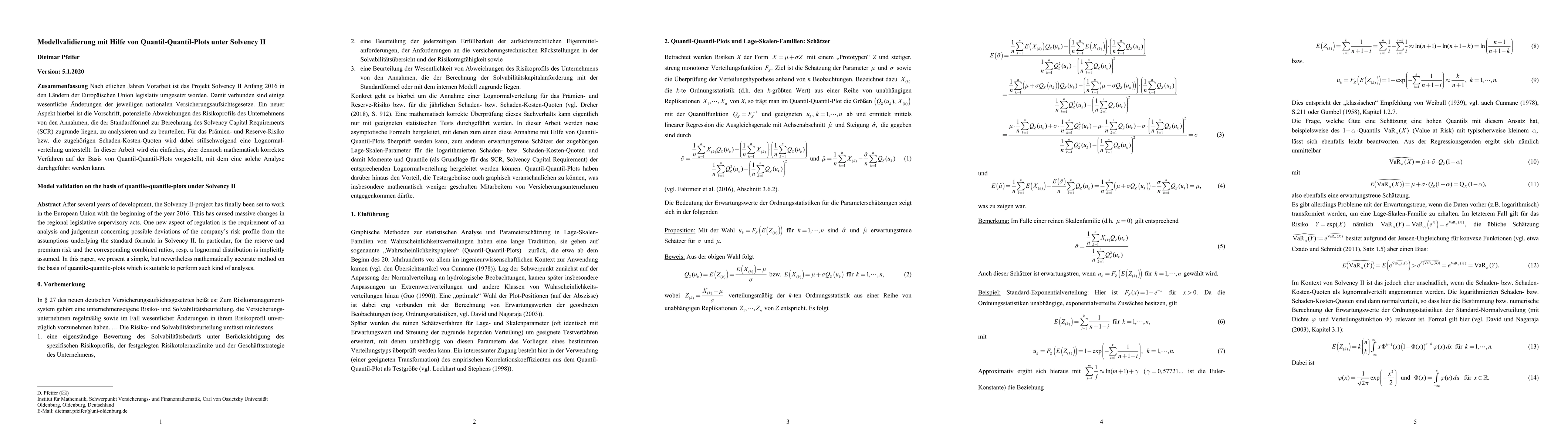

After several years of development, the Solvency II-project has finally been set to work in the European Union with the beginning of the year 2016. This has caused massive changes in the regional legislative supervisory acts. One new aspect of regulation is the requirement of an analysis and judgement concerning possible deviations of the company's risk profile from the assumptions underlying the standard formula in Solvency II. In particular, for the reserve and premium risk and the corresponding combined ratios, resp. a lognormal distribution is implicitly assumed. In this paper, we present a simple, but nevertheless mathematically accurate method on the basis of quantile-quantile-plots which is suitable to perform suvh kind of analyses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)