Summary

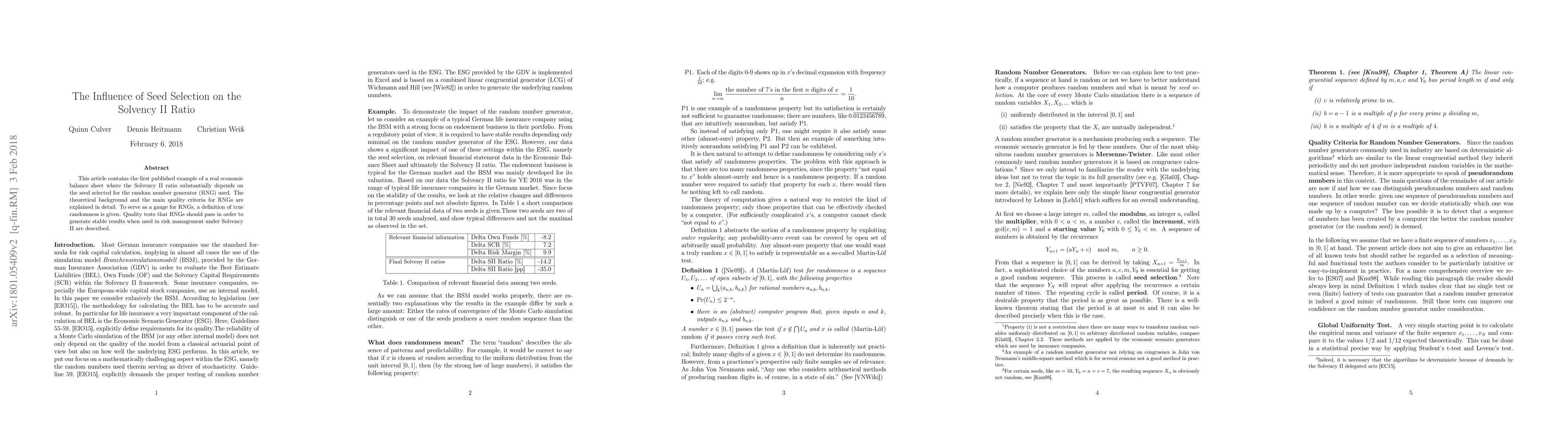

This article contains the first published example of a real economic balance sheet where the Solvency II ratio substantially depends on the seed selected for the random number generator (RNG) used. The theoretical background and the main quality criteria for RNGs are explained in detail. To serve as a gauge for RNGs, a definition of true randomness is given. Quality tests that RNGs should pass in order to generate stable results when used in risk management under Solvency II are described.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)