Summary

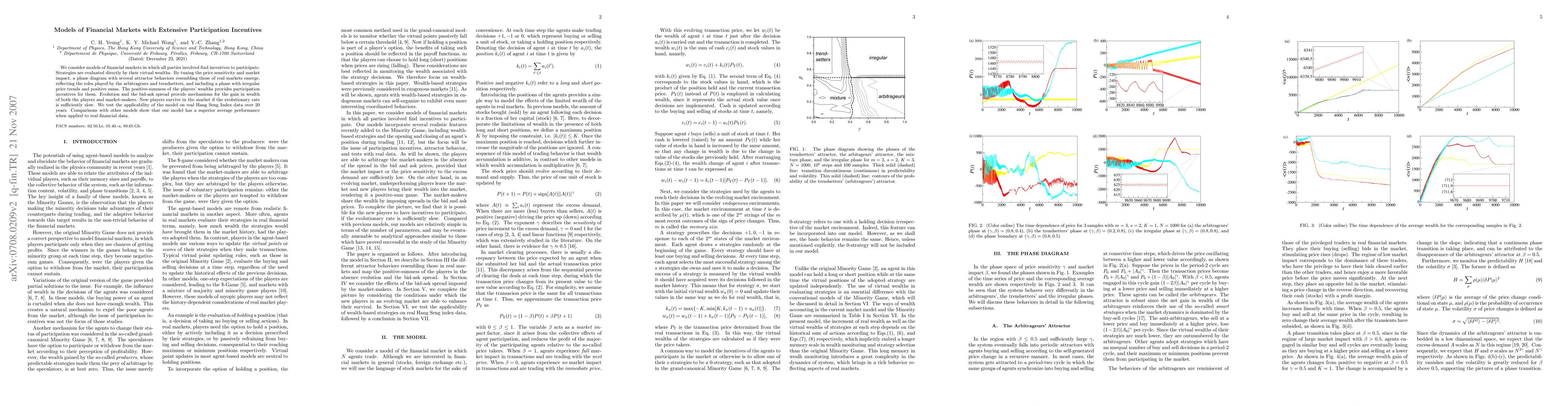

We consider models of financial markets in which all parties involved find incentives to participate. Strategies are evaluated directly by their virtual wealths. By tuning the price sensitivity and market impact, a phase diagram with several attractor behaviors resembling those of real markets emerge, reflecting the roles played by the arbitrageurs and trendsetters, and including a phase with irregular price trends and positive sums. The positive-sumness of the players' wealths provides participation incentives for them. Evolution and the bid-ask spread provide mechanisms for the gain in wealth of both the players and market-makers. New players survive in the market if the evolutionary rate is sufficiently slow. We test the applicability of the model on real Hang Seng Index data over 20 years. Comparisons with other models show that our model has a superior average performance when applied to real financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParticipation Incentives in Online Cooperative Games

Haris Aziz, Yuhang Guo, Zhaohong Sun

| Title | Authors | Year | Actions |

|---|

Comments (0)