Summary

We propose two specifications of a real-time mixed-frequency semi-structural time series model for evaluating the output potential, output gap, Phillips curve, and Okun's law for the US. The baseline model uses minimal theory-based multivariate identification restrictions to inform trend-cycle decomposition, while the alternative model adds the CBO's output gap measure as an observed variable. The latter model results in a smoother output potential and lower cyclical correlation between inflation and real variables but performs worse in forecasting beyond the short term. This methodology allows for the assessment and real-time monitoring of official trend and gap estimates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

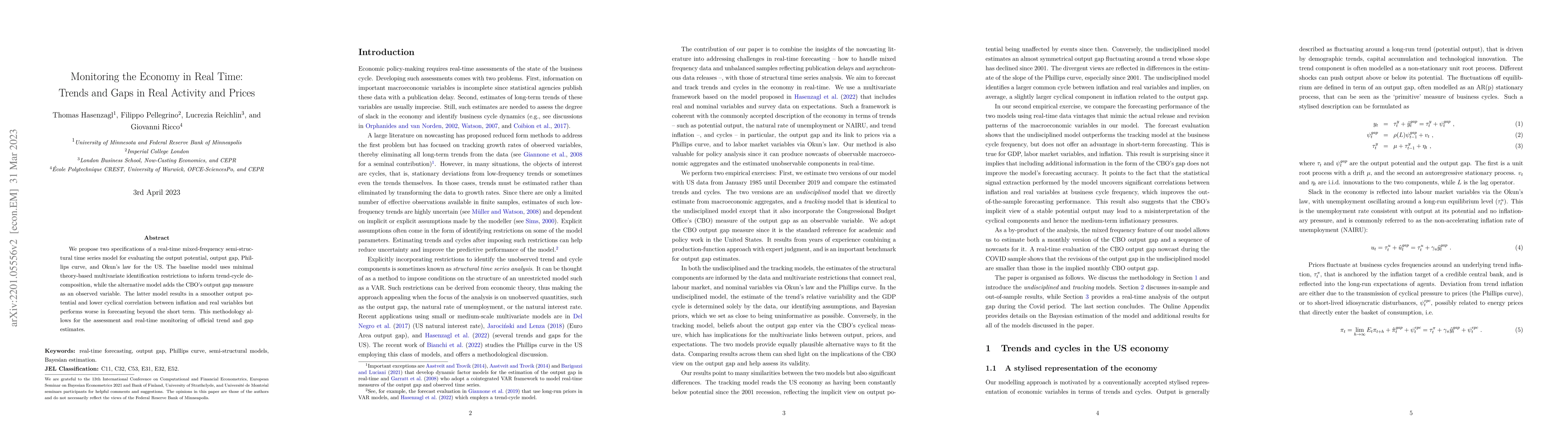

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)