Authors

Summary

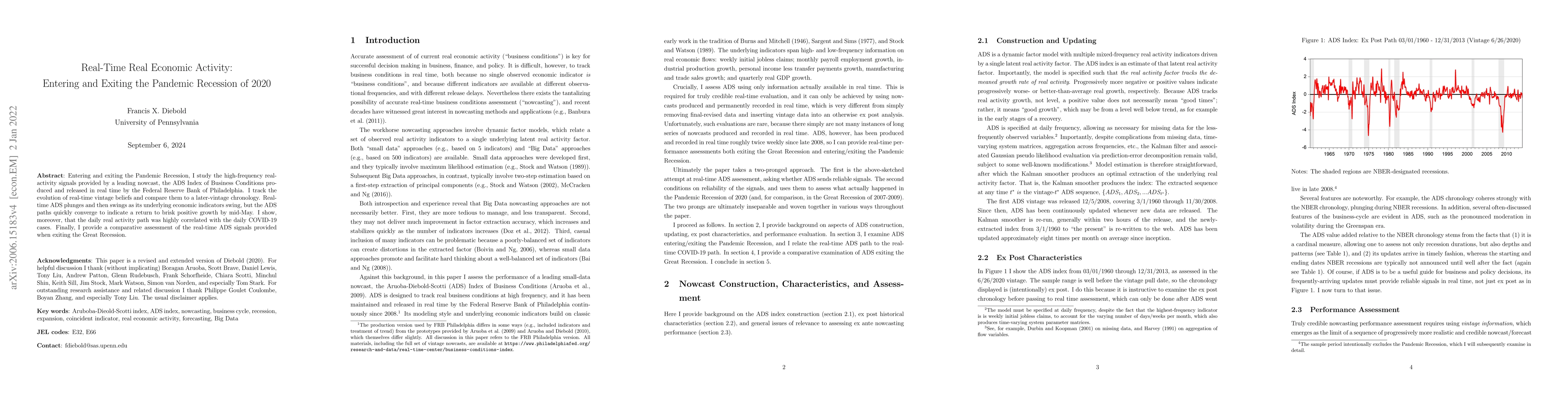

Entering and exiting the Pandemic Recession, I study the high-frequency real-activity signals provided by a leading nowcast, the ADS Index of Business Conditions produced and released in real time by the Federal Reserve Bank of Philadelphia. I track the evolution of real-time vintage beliefs and compare them to a later-vintage chronology. Real-time ADS plunges and then swings as its underlying economic indicators swing, but the ADS paths quickly converge to indicate a return to brisk positive growth by mid-May. I show, moreover, that the daily real activity path was highly correlated with the daily COVID-19 cases. Finally, I provide a comparative assessment of the real-time ADS signals provided when exiting the Great Recession.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research employs the ADS Index of Business Conditions produced by the Federal Reserve Bank of Philadelphia, a leading real-time nowcast, to study high-frequency real-activity signals during the Pandemic Recession of 2020. It compares real-time vintage beliefs with a later-vintage chronology, analyzing the correlation between real activity and COVID-19 cases.

Key Results

- The ADS Index plunged and then swung as underlying economic indicators swung during the pandemic, but quickly converged to indicate a return to brisk positive growth by mid-May.

- There is a strong correlation between the daily real activity path and daily COVID-19 cases.

- Real-time ADS signals were compared to those exiting the Great Recession, highlighting differences in their evolution and congealing of views.

Significance

This research is important as it provides real-time insights into economic activity during the Pandemic Recession, offering a valuable signal for navigating the path out of recession and comparing it to the Great Recession.

Technical Contribution

The paper clarifies the meaning of honest real-time nowcast/forecast evaluation and illustrates it using the ADS Business Conditions Index, which has been in operation for a long span, including the emergence from the Great Recession, entry into the Pandemic Recession, and exit from the Pandemic Recession.

Novelty

This work stands out by providing a detailed examination of real-time economic activity signals during the Pandemic Recession, comparing them to the Great Recession, and highlighting the strong correlation between real activity and COVID-19 cases.

Limitations

- The study is limited to the data available from the ADS Index and does not incorporate other economic indicators or models.

- The analysis focuses on the US economy and may not be generalizable to other countries or regions.

Future Work

- Future research could decompose ADS movements into shares coming from underlying indicators using observational weights from the Kalman filter or Shapley values.

- Investigating the performance of ADS during other historical recessions or unique economic events could provide additional insights.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)