Summary

In this paper we study nonlinear partial differential equations (PDEs) that are used to model different value adjustments denoted generally as xVA. These adjustments are nowadays commonly added to the risk-free financial derivative values and the PDE approach allows their easy incorporation. The aim of this paper is to apply the method of monotone iterations with sub- and supersolutions to the nonlinear Black-Scholes-type equation that occurs especially in the counterparty risk models. We introduce a monotone iteration scheme with semi-explicit solution formulas for each iteration step. Moreover, we show that the problem greatly simplifies for contracts with non-negative payoffs. To show the viability of the approach we apply our method to the call option, the forward, and the gap option.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

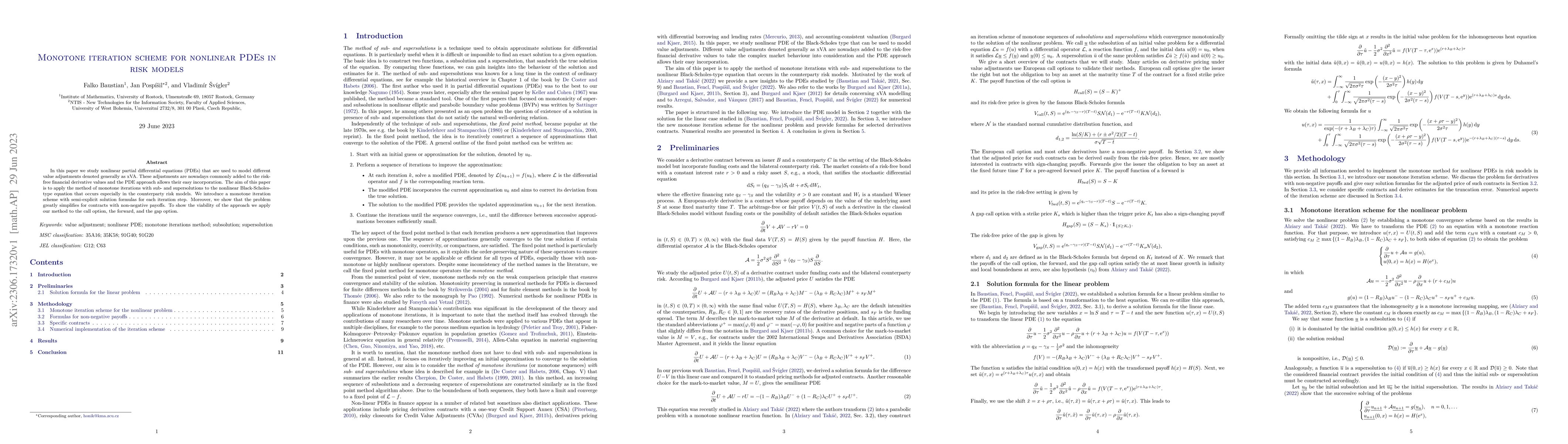

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Picard Iteration for High-Dimensional Nonlinear PDEs

Yue Zhao, Wei Hu, Jiequn Han et al.

No citations found for this paper.

Comments (0)