Authors

Summary

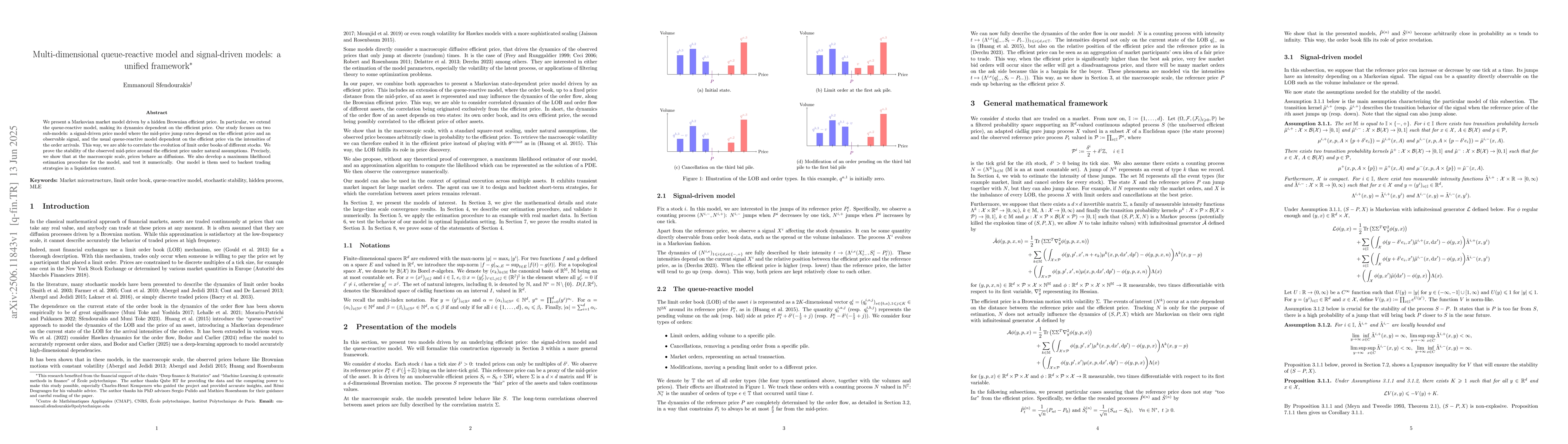

We present a Markovian market model driven by a hidden Brownian efficient price. In particular, we extend the queue-reactive model, making its dynamics dependent on the efficient price. Our study focuses on two sub-models: a signal-driven price model where the mid-price jump rates depend on the efficient price and an observable signal, and the usual queue-reactive model dependent on the efficient price via the intensities of the order arrivals. This way, we are able to correlate the evolution of limit order books of different stocks. We prove the stability of the observed mid-price around the efficient price under natural assumptions. Precisely, we show that at the macroscopic scale, prices behave as diffusions. We also develop a maximum likelihood estimation procedure for the model, and test it numerically. Our model is them used to backest trading strategies in a liquidation context.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Meets Queue-Reactive: A Framework for Realistic Limit Order Book Simulation

Hamza Bodor, Laurent Carlier

A Novel Approach to Queue-Reactive Models: The Importance of Order Sizes

Hamza Bodor, Laurent Carlier

No citations found for this paper.

Comments (0)