Authors

Summary

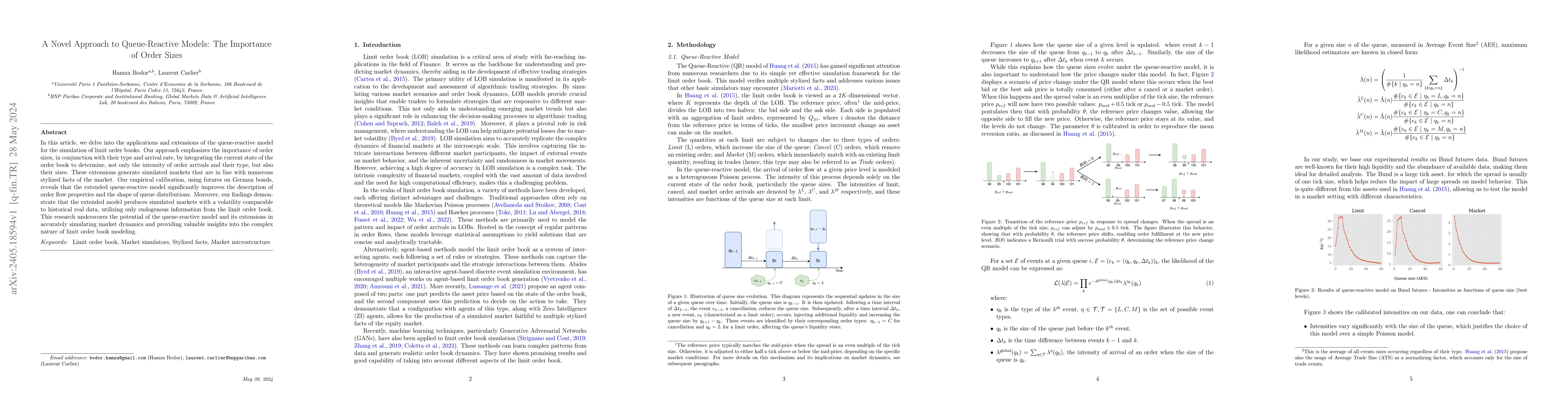

In this article, we delve into the applications and extensions of the queue-reactive model for the simulation of limit order books. Our approach emphasizes the importance of order sizes, in conjunction with their type and arrival rate, by integrating the current state of the order book to determine, not only the intensity of order arrivals and their type, but also their sizes. These extensions generate simulated markets that are in line with numerous stylized facts of the market. Our empirical calibration, using futures on German bonds, reveals that the extended queue-reactive model significantly improves the description of order flow properties and the shape of queue distributions. Moreover, our findings demonstrate that the extended model produces simulated markets with a volatility comparable to historical real data, utilizing only endogenous information from the limit order book. This research underscores the potential of the queue-reactive model and its extensions in accurately simulating market dynamics and providing valuable insights into the complex nature of limit order book modeling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Meets Queue-Reactive: A Framework for Realistic Limit Order Book Simulation

Hamza Bodor, Laurent Carlier

Multi-dimensional queue-reactive model and signal-driven models: a unified framework

Emmanouil Sfendourakis

No citations found for this paper.

Comments (0)