Summary

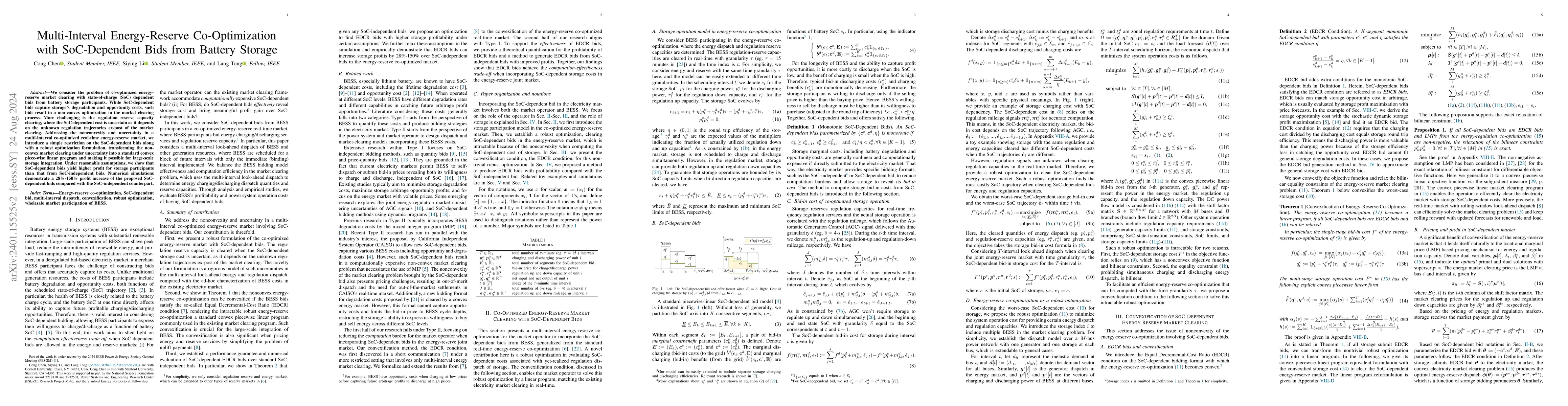

We consider the problem of co-optimized energy-reserve market clearing with state-of-charge (SoC) dependent bids from battery storage participants. While SoC-dependent bidding accurately captures storage's degradation and opportunity costs, such bids result in a non-convex optimization in the market clearing process. More challenging is the regulation reserve capacity clearing, where the SoC-dependent cost is uncertain as it depends on the unknown regulation trajectories ex-post of the market clearing. Addressing the nonconvexity and uncertainty in a multi-interval co-optimized real-time energy-reserve market, we introduce a simple restriction on the SoC-dependent bids along with a robust optimization formulation, transforming the non-convex market clearing under uncertainty into a standard convex piece-wise linear program and making it possible for large-scale storage integration. Under reasonable assumptions, we show that SoC-dependent bids yield higher profit for storage participants than that from SoC-independent bids. Numerical simulations demonstrate a 28%-150% profit increase of the proposed SoC-dependent bids compared with the SoC-independent counterpart.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvexifying Market Clearing of SoC-Dependent Bids from Merchant Storage Participants

Cong Chen, Lang Tong

Wholesale Market Participation of Storage with State-of-Charge Dependent Bids

Cong Chen, Lang Tong

Coordinated Trading Strategies for Battery Storage in Reserve and Spot Markets

Paul E. Seifert, Emil Kraft, Steffen Bakker et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)