Summary

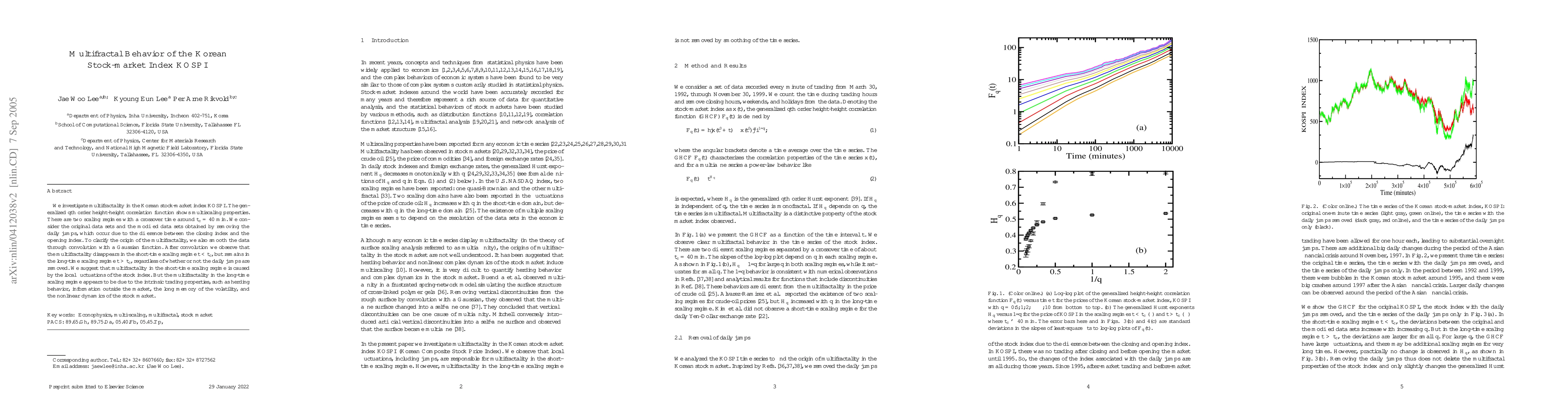

We investigate multifractality in the Korean stock-market index KOSPI. The

generalized $q$th order height-height correlation function shows multiscaling

properties. There are two scaling regimes with a crossover time around $t_c

=40$ min. We consider the original data sets and the modified data sets

obtained by removing the daily jumps, which occur due to the difference between

the closing index and the opening index. To clarify the origin of the

multifractality, we also smooth the data through convolution with a Gaussian

function. After convolution we observe that the multifractality disappears in

the short-time scaling regime $t

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)