Summary

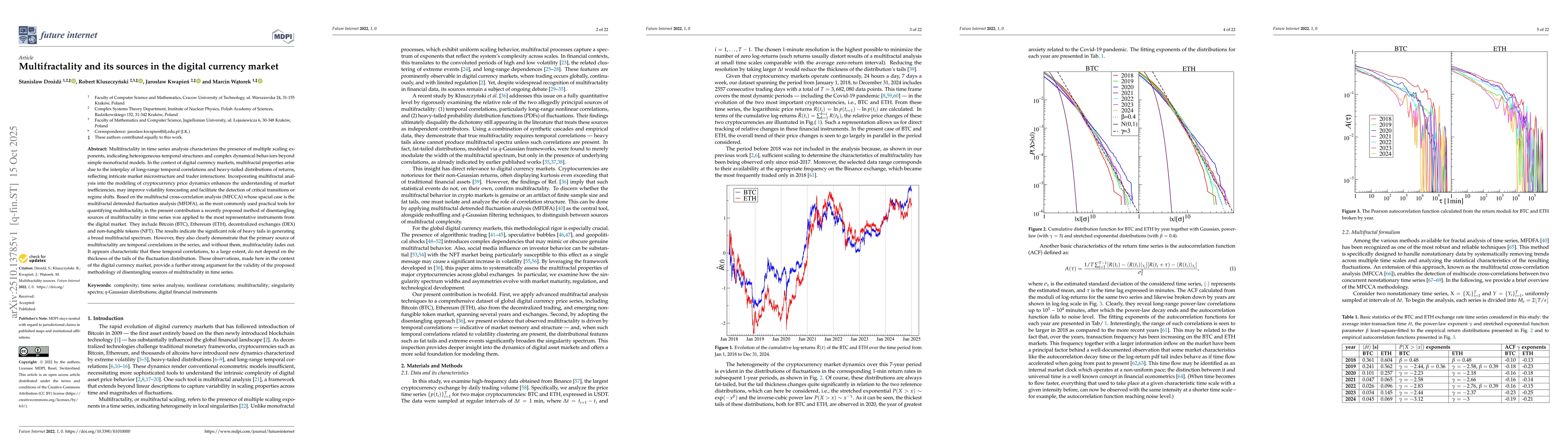

Multifractality in time series analysis characterizes the presence of multiple scaling exponents, indicating heterogeneous temporal structures and complex dynamical behaviors beyond simple monofractal models. In the context of digital currency markets, multifractal properties arise due to the interplay of long-range temporal correlations and heavy-tailed distributions of returns, reflecting intricate market microstructure and trader interactions. Incorporating multifractal analysis into the modeling of cryptocurrency price dynamics enhances the understanding of market inefficiencies, may improve volatility forecasting and facilitate the detection of critical transitions or regime shifts. Based on the multifractal cross-correlation analysis (MFCCA) whose spacial case is the multifractal detrended fluctuation analysis (MFDFA), as the most commonly used practical tools for quantifying multifractality, in the present contribution a recently proposed method of disentangling sources of multifractality in time series was applied to the most representative instruments from the digital market. They include Bitcoin (BTC), Ethereum (ETH), decentralized exchanges (DEX) and non-fungible tokens (NFT). The results indicate the significant role of heavy tails in generating a broad multifractal spectrum. However, they also clearly demonstrate that the primary source of multifractality are temporal correlations in the series, and without them, multifractality fades out. It appears characteristic that these temporal correlations, to a large extent, do not depend on the thickness of the tails of the fluctuation distribution. These observations, made here in the context of the digital currency market, provide a further strong argument for the validity of the proposed methodology of disentangling sources of multifractality in time series.

AI Key Findings

Generated Oct 29, 2025

Methodology

The study employed multifractal detrended fluctuation analysis (MF-DFA) and detrended cross-correlation analysis (DCCA) to examine the multifractal properties and cross-correlations of cryptocurrency and NFT markets.

Key Results

- Cryptocurrencies exhibit long-range correlations and multifractal behavior indicative of market inefficiencies

- NFT markets show distinct multifractal characteristics compared to cryptocurrencies

- Cross-correlations between cryptocurrency and NFT markets reveal complex dependencies

Significance

This research provides insights into market dynamics and risk management for digital asset markets, with implications for financial regulation and investment strategies

Technical Contribution

Development of enhanced multifractal analysis frameworks for financial time series

Novelty

First comprehensive analysis comparing multifractal properties of cryptocurrency and NFT markets using advanced cross-correlation techniques

Limitations

- Analysis focused on specific cryptocurrency and NFT datasets

- Potential biases from market volatility during the study period

Future Work

- Exploring multifractal analysis of other digital assets

- Investigating temporal evolution of market correlations

Paper Details

PDF Preview

Similar Papers

Found 5 papersCentral Bank Digital Currency: The Advent of its IT Governance in the financial markets

Carlos Alberto Durigan Junior, Mauro De Mesquita Spinola, Rodrigo Franco Gonçalves et al.

Comments (0)