Authors

Summary

This manuscript introduces deep learning models that simultaneously describe the dynamics of several yield curves. We aim to learn the dependence structure among the different yield curves induced by the globalization of financial markets and exploit it to produce more accurate forecasts. By combining the self-attention mechanism and nonparametric quantile regression, our model generates both point and interval forecasts of future yields. The architecture is designed to avoid quantile crossing issues affecting multiple quantile regression models. Numerical experiments conducted on two different datasets confirm the effectiveness of our approach. Finally, we explore potential extensions and enhancements by incorporating deep ensemble methods and transfer learning mechanisms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

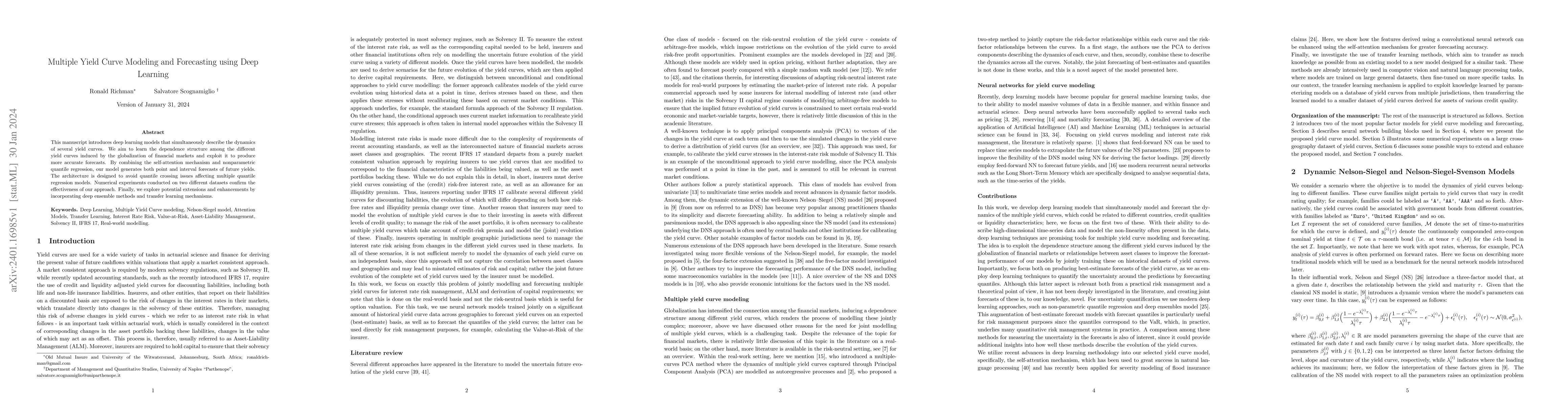

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)