Authors

Summary

We study a continuous-time Markowitz mean-variance portfolio selection model in which a naive agent, unaware of the underlying time-inconsistency, continuously reoptimizes over time. We define the resulting naive policies through the limit of discretely naive policies that are committed only in very small time intervals, and derive them analytically and explicitly. We compare naive policies with pre-committed optimal policies and with consistent planners' equilibrium policies in a Black-Scholes market, and find that the former are mean-variance inefficient starting from any given time and wealth, and always take riskier exposure than equilibrium policies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

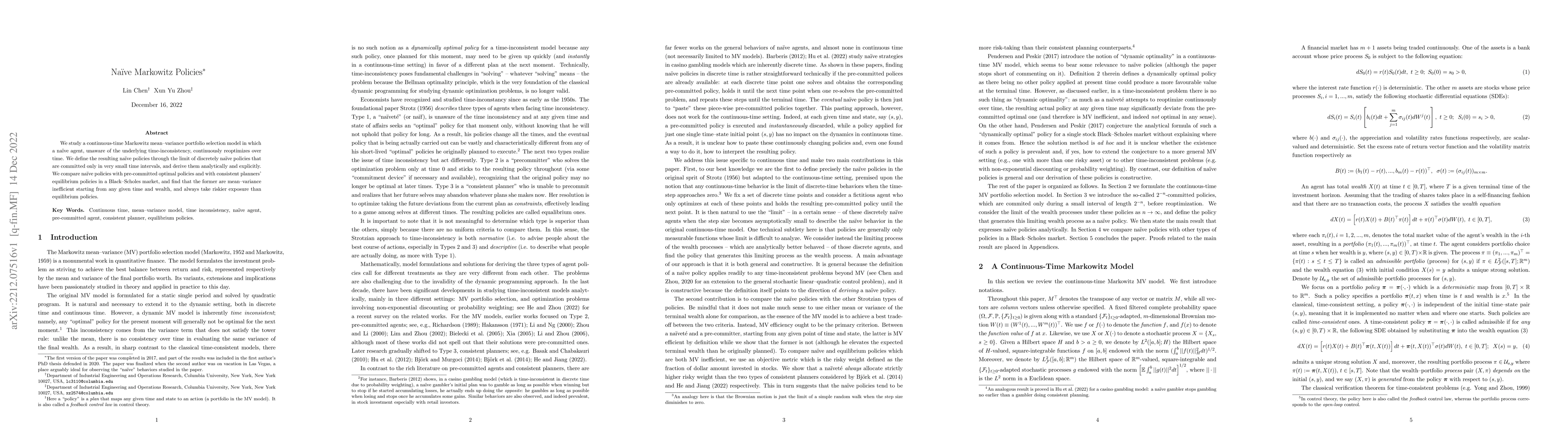

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobustifying Markowitz

Nikita Zhivotovskiy, Wolfgang Karl Härdle, Yegor Klochkov et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)