Summary

The interest rates (or nominal yields) can be negative, this is an unavoidable fact which has already been visible during the Great Depression (1929-39). Nowadays we can find negative rates easily by e.g. auditing. Several theoretical and practical ideas how to model and eventually overcome empirical negative rates can be suggested, however, they are far beyond a simple practical realization. In this paper we discuss the dynamical reasons why negative interest rates can happen in the second order differential dynamics and how they can influence the variance and expectation of the interest rate process. Such issues are highly practical, involving e.g. banking sector and pension securities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

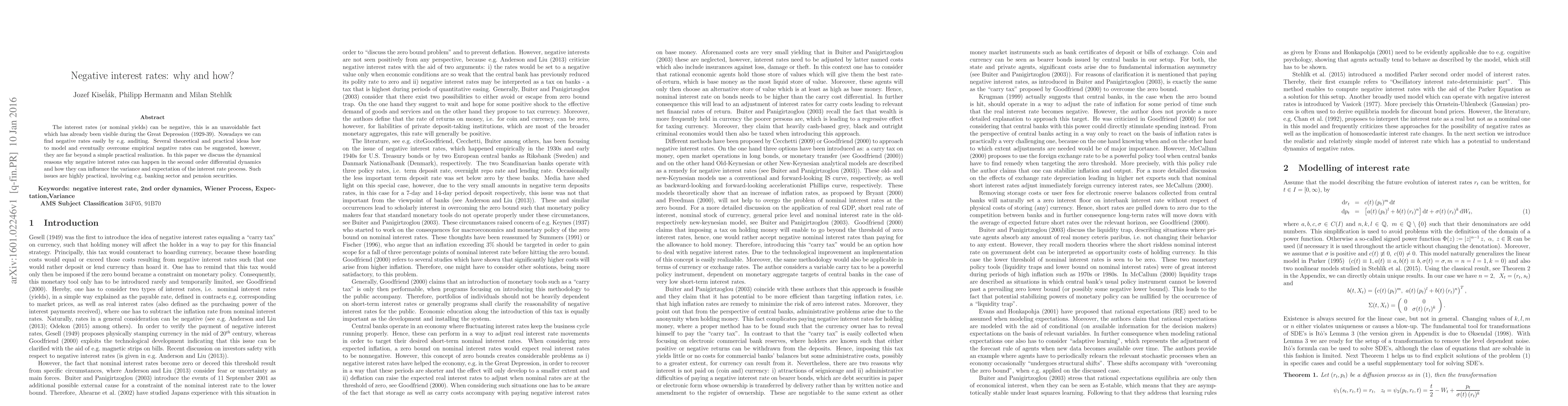

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSincov's and other functional equations and negative interest rates

Gergely Kiss, Jens Schwaiger

| Title | Authors | Year | Actions |

|---|

Comments (0)