Summary

In this paper we offer a novel type of network model which can capture the precise structure of a financial market based, for example, on empirical findings. With the attached stochastic framework it is further possible to study how an arbitrary network structure and its expected counterparty credit risk are analytically related to each other. This allows us, for the first time, to model the precise structure of an arbitrary financial market and to derive the corresponding expected exposure in a closed-form expression. It further enables us to draw implications for the study of systemic risk. We apply the powerful theory of characteristic functions and Hilbert transforms. The latter concept is used to express the characteristic function (c.f.) of the random variable (r.v.) $\max(Y, 0)$ in terms of the c.f. of the r.v. $Y$. The present paper applies this concept for the first time in mathematical finance. We then characterise Eulerian digraphs as distinguished exposure structures and show that considering the precise network structures is crucial for the study of systemic risk. The introduced network model is then applied to study the features of an over-the-counter and a centrally cleared market. We also give a more general answer to the question of whether it is more advantageous for the overall counterparty credit risk to clear via a central counterparty or classically bilateral between the two involved counterparties. We then show that the exact market structure is a crucial factor in answering the raised question.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

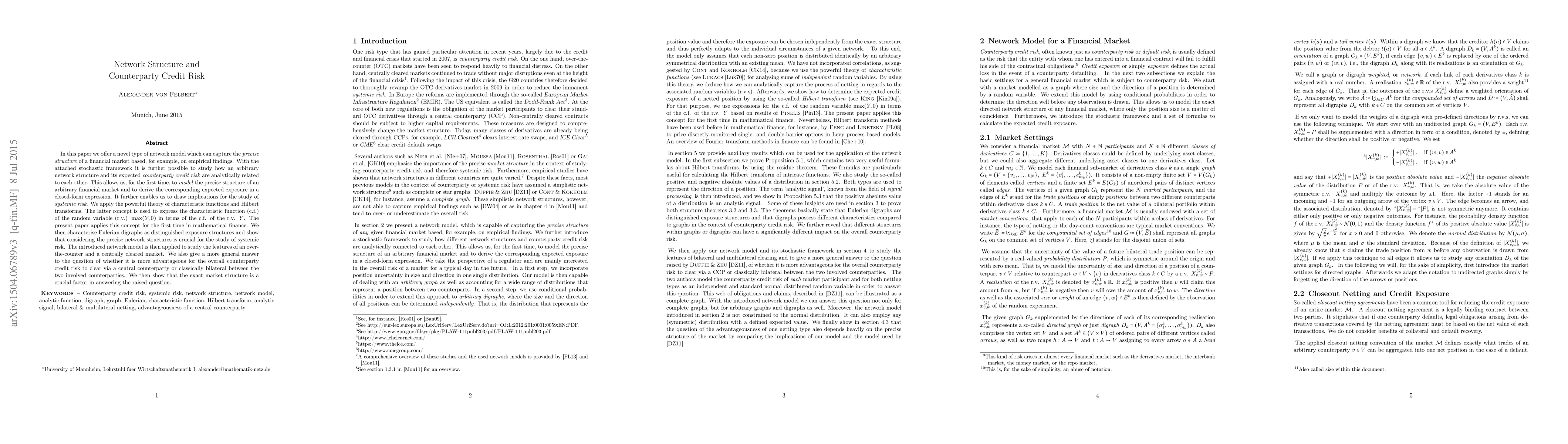

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)