Summary

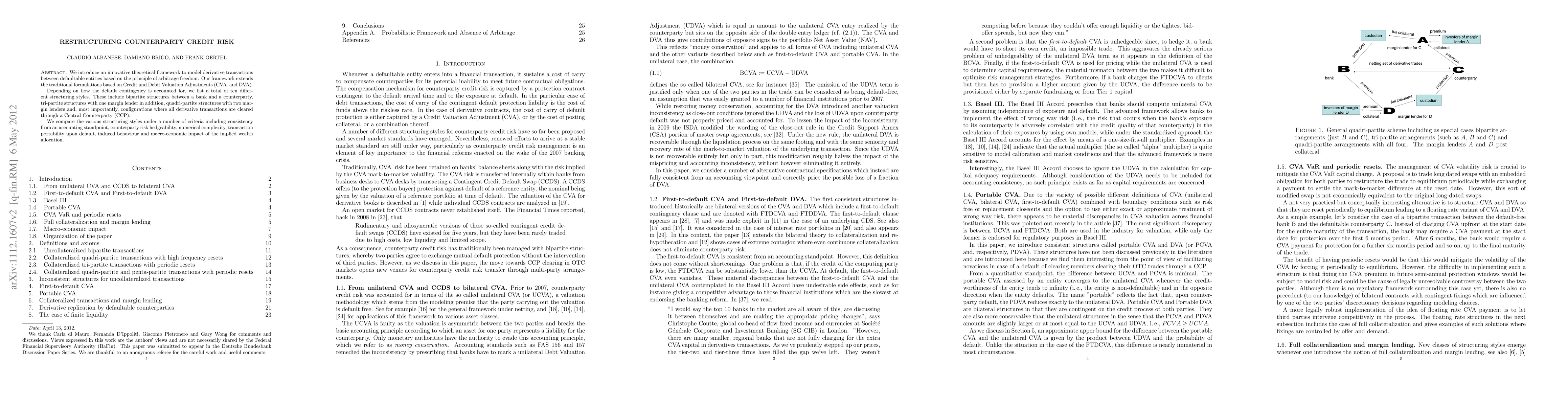

We introduce an innovative theoretical framework to model derivative transactions between defaultable entities based on the principle of arbitrage freedom. Our framework extends the traditional formulations based on Credit and Debit Valuation Adjustments (CVA and DVA). Depending on how the default contingency is accounted for, we list a total of ten different structuring styles. These include bipartite structures between a bank and a counterparty, tri-partite structures with one margin lender in addition, quadri-partite structures with two margin lenders and, most importantly, configurations where all derivative transactions are cleared through a Central Counterparty (CCP). We compare the various structuring styles under a number of criteria including consistency from an accounting standpoint, counterparty risk hedgeability, numerical complexity, transaction portability upon default, induced behaviour and macro-economic impact of the implied wealth allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)