Summary

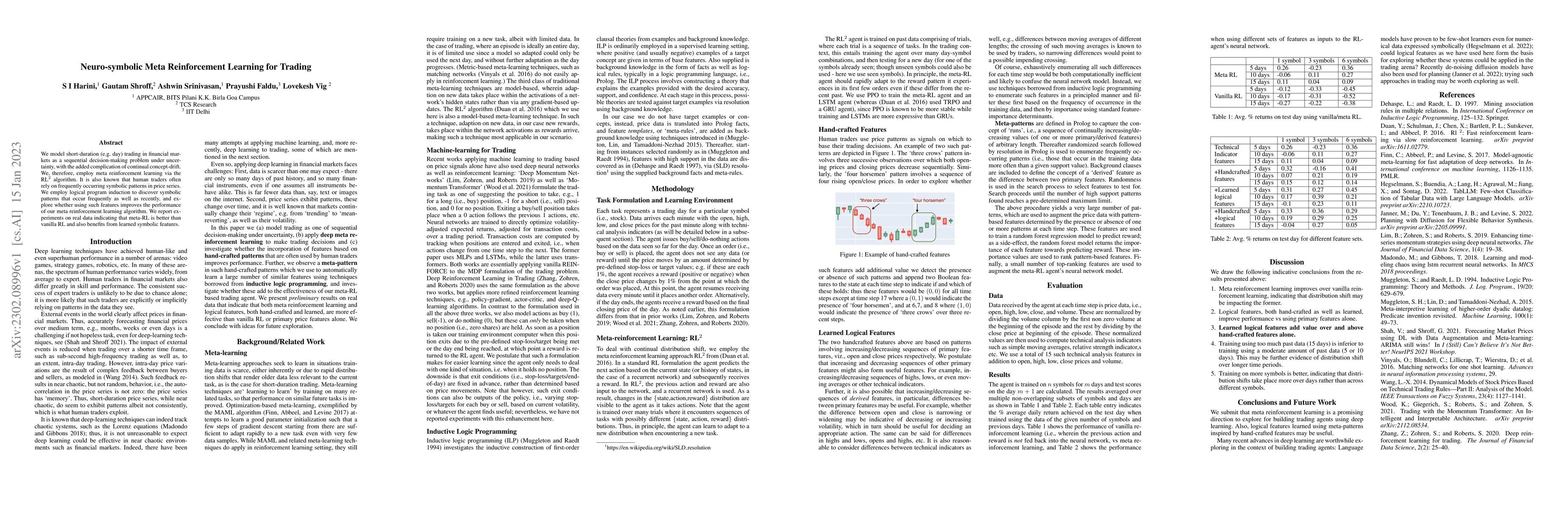

We model short-duration (e.g. day) trading in financial markets as a sequential decision-making problem under uncertainty, with the added complication of continual concept-drift. We, therefore, employ meta reinforcement learning via the RL2 algorithm. It is also known that human traders often rely on frequently occurring symbolic patterns in price series. We employ logical program induction to discover symbolic patterns that occur frequently as well as recently, and explore whether using such features improves the performance of our meta reinforcement learning algorithm. We report experiments on real data indicating that meta-RL is better than vanilla RL and also benefits from learned symbolic features.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Explainable Relational Reinforcement Learning: A Neuro-Symbolic Approach

Luc De Raedt, Rishi Hazra

End-to-End Neuro-Symbolic Reinforcement Learning with Textual Explanations

Qing Li, Yaodong Yang, Hongming Xu et al.

Automaton Distillation: Neuro-Symbolic Transfer Learning for Deep Reinforcement Learning

Alvaro Velasquez, George Atia, Andre Beckus et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)