Authors

Summary

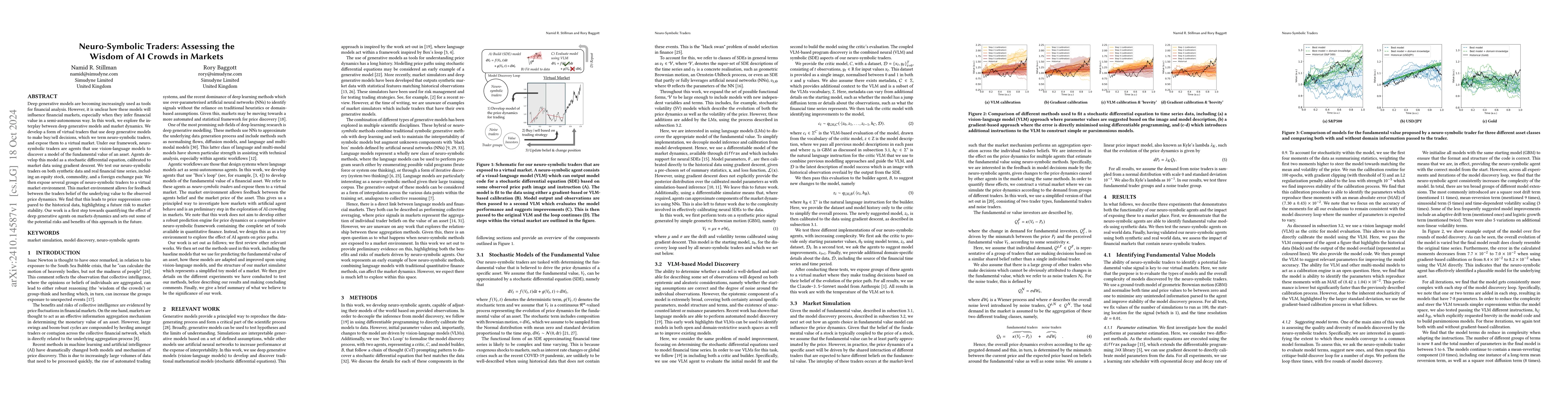

Deep generative models are becoming increasingly used as tools for financial analysis. However, it is unclear how these models will influence financial markets, especially when they infer financial value in a semi-autonomous way. In this work, we explore the interplay between deep generative models and market dynamics. We develop a form of virtual traders that use deep generative models to make buy/sell decisions, which we term neuro-symbolic traders, and expose them to a virtual market. Under our framework, neuro-symbolic traders are agents that use vision-language models to discover a model of the fundamental value of an asset. Agents develop this model as a stochastic differential equation, calibrated to market data using gradient descent. We test our neuro-symbolic traders on both synthetic data and real financial time series, including an equity stock, commodity, and a foreign exchange pair. We then expose several groups of neuro-symbolic traders to a virtual market environment. This market environment allows for feedback between the traders belief of the underlying value to the observed price dynamics. We find that this leads to price suppression compared to the historical data, highlighting a future risk to market stability. Our work is a first step towards quantifying the effect of deep generative agents on markets dynamics and sets out some of the potential risks and benefits of this approach in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNeuro-Symbolic AI for Military Applications

Desta Haileselassie Hagos, Danda B. Rawat

Formal Explanations for Neuro-Symbolic AI

Peter J. Stuckey, Alexey Ignatiev, Jinqiang Yu et al.

Neuro-Symbolic AI in 2024: A Systematic Review

William Regli, Brandon C. Colelough

No citations found for this paper.

Comments (0)