Summary

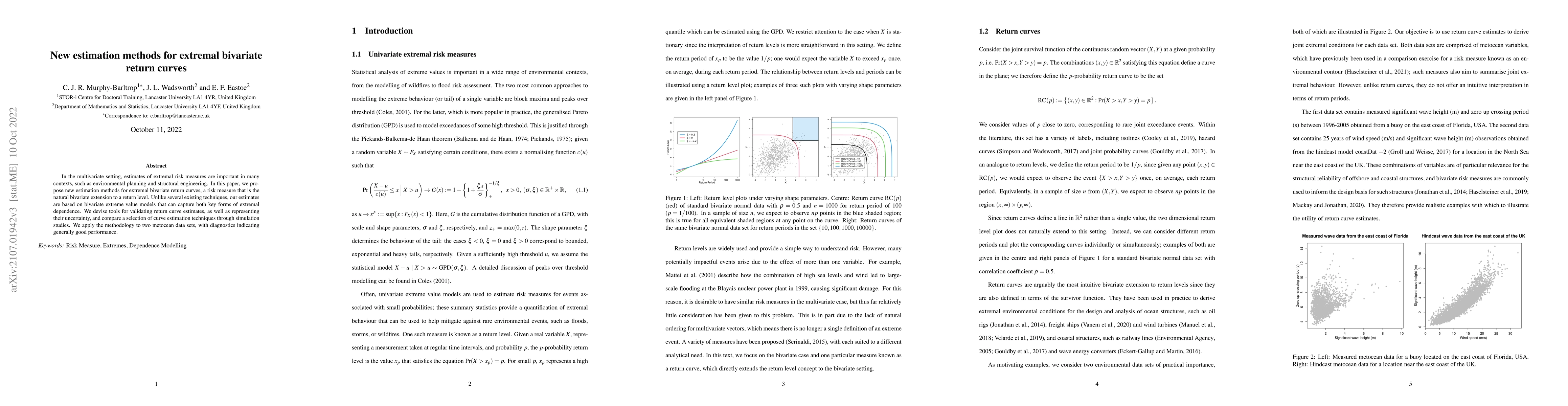

In the multivariate setting, estimates of extremal risk measures are important in many contexts, such as environmental planning and structural engineering. In this paper, we propose new estimation methods for extremal bivariate return curves, a risk measure that is the natural bivariate extension to a return level. Unlike several existing techniques, our estimates are based on bivariate extreme value models that can capture both key forms of extremal dependence. We devise tools for validating return curve estimates, as well as representing their uncertainty, and compare a selection of curve estimation techniques through simulation studies. We apply the methodology to two metocean data sets, with diagnostics indicating generally good performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParameter Estimation Methods of Required Rate of Return on Stock

Battulga Gankhuu

Bivariate vine copula based regression, bivariate level and quantile curves

Claudia Czado, Marija Tepegjozova

| Title | Authors | Year | Actions |

|---|

Comments (0)