Authors

Summary

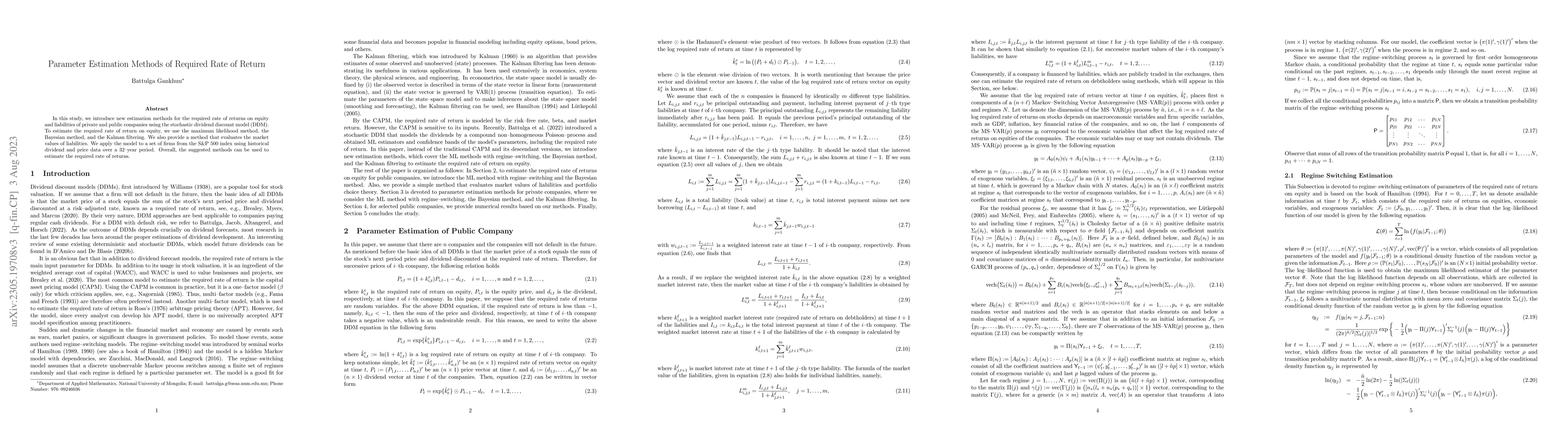

In this study, we introduce new estimation methods for the required rate of returns on equity and liabilities of private and public companies using the stochastic dividend discount model (DDM). To estimate the required rate of return on equity, we use the maximum likelihood method, the Bayesian method, and the Kalman filtering. We also provide a method that evaluates the market values of liabilities. We apply the model to a set of firms from the S\&P 500 index using historical dividend and price data over a 32--year period. Overall, the suggested methods can be used to estimate the required rate of returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParameter Estimation Methods of Required Rate of Return on Stock

Battulga Gankhuu

New estimation methods for extremal bivariate return curves

C. J. R. Murphy-Barltrop, J. L. Wadsworth, E. F. Eastoe

A Comparison of Parameter Estimation Methods for Shared Frailty Models

Tingxuan Wu, Cindy Feng, Longhai Li

| Title | Authors | Year | Actions |

|---|

Comments (0)