Authors

Summary

We propose a set of dependence measures that are non-linear, local, invariant to a wide range of transformations on the marginals, can show tail and risk asymmetries, are always well-defined, are easy to estimate and can be used on any dataset. We propose a nonparametric estimator and prove its consistency and asymptotic normality. Thereby we significantly improve on existing (extreme) dependence measures used in asset pricing and statistics. To show practical utility, we use these measures on high-frequency stock return data around market distress events such as the 2010 Flash Crash and during the GFC. Contrary to ubiquitously used correlations we find that our measures clearly show tail asymmetry, non-linearity, lack of diversification and endogenous buildup of risks present during these distress events. Additionally, our measures anticipate large (joint) losses during the Flash Crash while also anticipating the bounce back and flagging the subsequent market fragility. Our findings have implications for risk management, portfolio construction and hedging at any frequency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

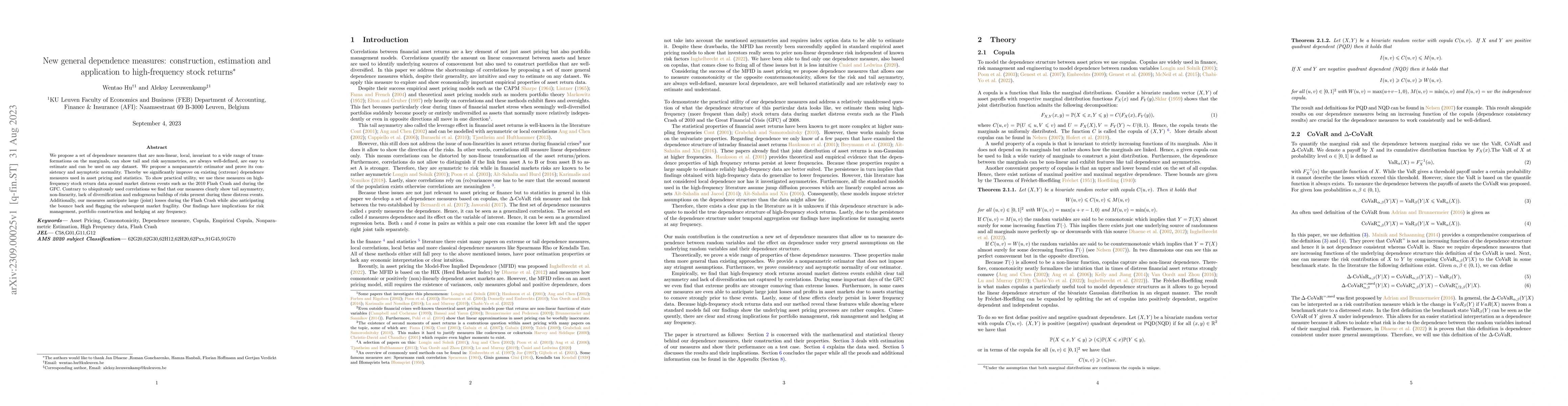

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)