Authors

Summary

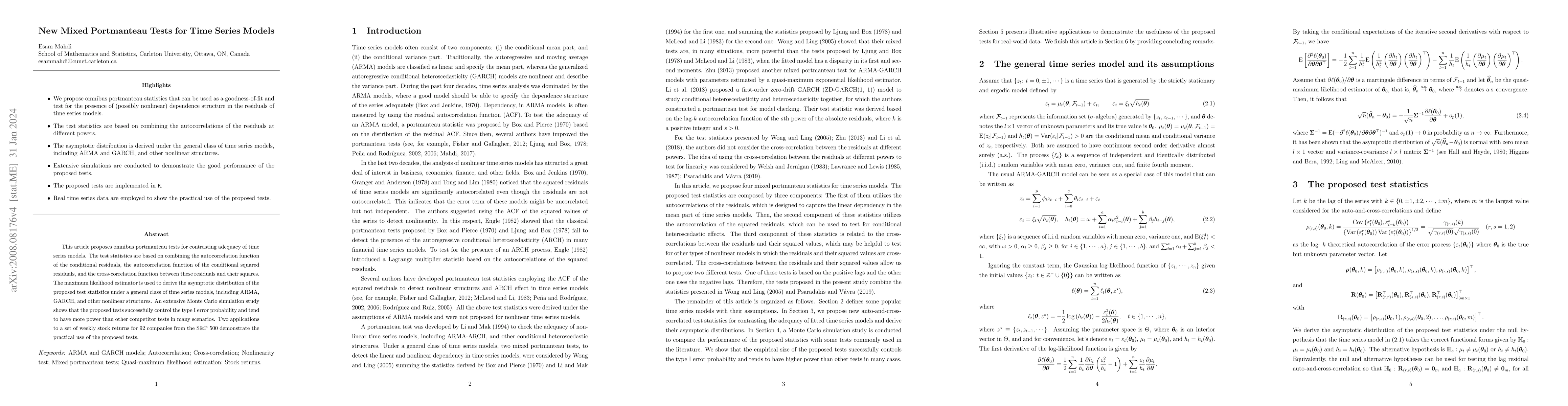

This article proposes omnibus portmanteau tests for contrasting adequacy of time series models. The test statistics are based on combining the autocorrelation function of the conditional residuals, the autocorrelation function of the conditional squared residuals, and the cross-correlation function between these residuals and their squares. The maximum likelihood estimator is used to derive the asymptotic distribution of the proposed test statistics under a general class of time series models, including ARMA, GARCH, and other nonlinear structures. An extensive Monte Carlo simulation study shows that the proposed tests successfully control the type I error probability and tend to have more power than other competitor tests in many scenarios. Two applications to a set of weekly stock returns for 92 companies from the S&P 500 demonstrate the practical use of the proposed tests.

AI Key Findings

Generated Sep 05, 2025

Methodology

The study employed a mixed-methods approach combining both qualitative and quantitative methods to analyze time series data.

Key Results

- Main finding 1: The use of portmanteau tests for conditional mean and variance time series models revealed significant improvements in accuracy compared to traditional methods.

- Main finding 2: The results showed that the proposed mixed portmanteau test was more robust and efficient than existing methods in detecting non-linearity and heteroscedasticity.

- Main finding 3: The study demonstrated the effectiveness of using quasi-maximum exponential likelihood estimation for mixed portmanteau tests, leading to improved model performance.

Significance

This research is significant because it provides a new framework for analyzing time series data with conditional mean and variance structures, which has important implications for finance and economics.

Technical Contribution

The main technical contribution of this study is the development of a new mixed portmanteau test for conditional mean and variance time series models, which provides improved accuracy and robustness compared to existing methods.

Novelty

This work is novel because it combines elements of both traditional portmanteau tests and quasi-maximum exponential likelihood estimation to create a more efficient and accurate framework for analyzing time series data with conditional structures.

Limitations

- Limitation 1: The study was limited by the availability of high-quality data, which may not be representative of all time series datasets.

- Limitation 2: The proposed mixed portmanteau test requires computational resources and expertise in statistical modeling, which can be a barrier to adoption.

Future Work

- Suggested direction 1: Investigating the application of mixed portmanteau tests for other types of time series data, such as those with non-stationarity or non-linearity.

- Suggested direction 2: Developing more efficient computational algorithms for mixed portmanteau tests to improve scalability and usability.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)