Authors

Summary

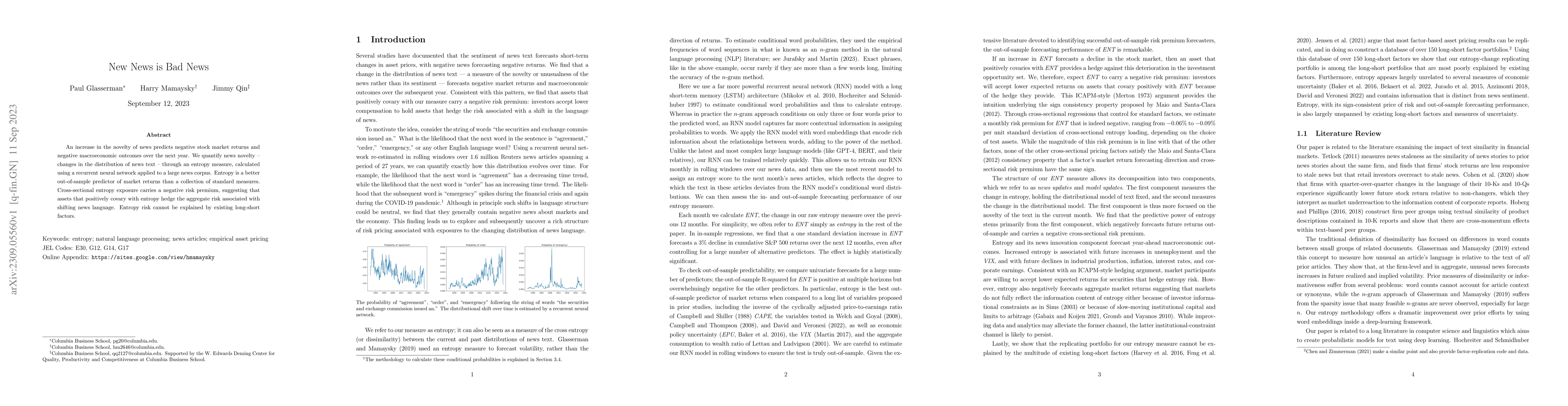

An increase in the novelty of news predicts negative stock market returns and negative macroeconomic outcomes over the next year. We quantify news novelty - changes in the distribution of news text - through an entropy measure, calculated using a recurrent neural network applied to a large news corpus. Entropy is a better out-of-sample predictor of market returns than a collection of standard measures. Cross-sectional entropy exposure carries a negative risk premium, suggesting that assets that positively covary with entropy hedge the aggregate risk associated with shifting news language. Entropy risk cannot be explained by existing long-short factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)