Authors

Summary

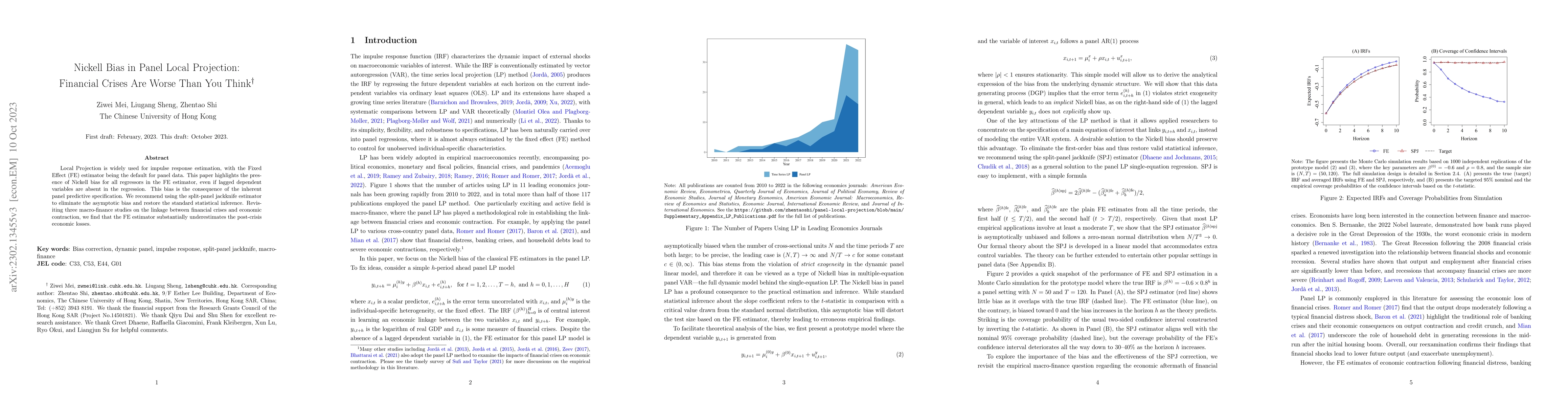

Local Projection is widely used for impulse response estimation, with the Fixed Effect (FE) estimator being the default for panel data. This paper highlights the presence of Nickell bias for all regressors in the FE estimator, even if lagged dependent variables are absent in the regression. This bias is the consequence of the inherent panel predictive specification. We recommend using the split-panel jackknife estimator to eliminate the asymptotic bias and restore the standard statistical inference. Revisiting three macro-finance studies on the linkage between financial crises and economic contraction, we find that the FE estimator substantially underestimates the post-crisis economic losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNickell Meets Stambaugh: A Tale of Two Biases in Panel Predictive Regressions

Ziwei Mei, Zhentao Shi, Chengwang Liao

Local Projection Inference is Simpler and More Robust Than You Think

Mikkel Plagborg-Møller, José Luis Montiel Olea

ResNets Are Deeper Than You Think

Michael Wand, Christian H. X. Ali Mehmeti-Göpel

| Title | Authors | Year | Actions |

|---|

Comments (0)