Summary

Market impact is the link between the volume of a (large) order and the price move during and after the execution of this order. We show that under no-arbitrage assumption, the market impact function can only be of power-law type. Furthermore, we prove that this implies that the macroscopic price is diffusive with rough volatility, with a one-to-one correspondence between the exponent of the impact function and the Hurst parameter of the volatility. Hence we simply explain the universal rough behavior of the volatility as a consequence of the no-arbitrage property. From a mathematical viewpoint, our study relies in particular on new results about hyper-rough stochastic Volterra equations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

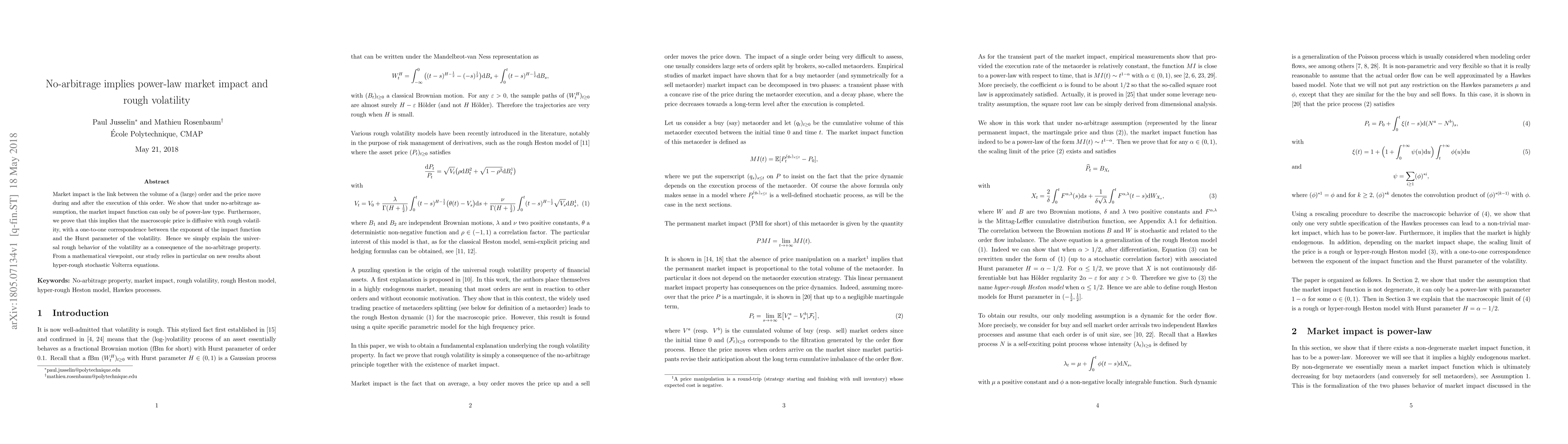

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo-Arbitrage Deep Calibration for Volatility Smile and Skewness

Paolo Barucca, Kentaro Hoshisashi, Carolyn E. Phelan

| Title | Authors | Year | Actions |

|---|

Comments (0)