Summary

We prove a version of First Fundamental Theorem of Asset Pricing under transaction costs for discrete-time markets with dividend-paying securities. Specifically, we show that the no-arbitrage condition under the efficient friction assumption is equivalent to the existence of a risk-neutral measure. We derive dual representations for the superhedging ask and subhedging bid price processes of a derivative contract. Our results are illustrated with a vanilla credit default swap contract.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

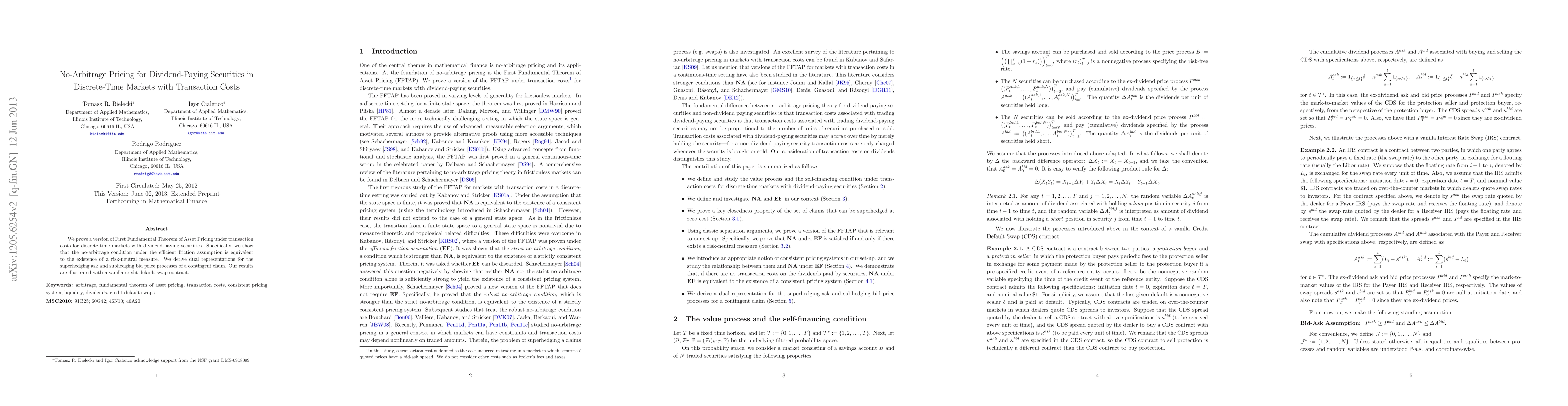

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)