Summary

In a discrete time and multiple-priors setting, we propose a new characterisation of the condition of quasi-sure no-arbitrage which has become a standard assumption. This characterisation shows that it is indeed a well-chosen condition being equivalent to several previously used alternative notions of no-arbitrage and allowing the proof of important results in mathematical finance. We also revisit the so-called geometric and quantitative no-arbitrage conditions and explicit two important examples where all these concepts are illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

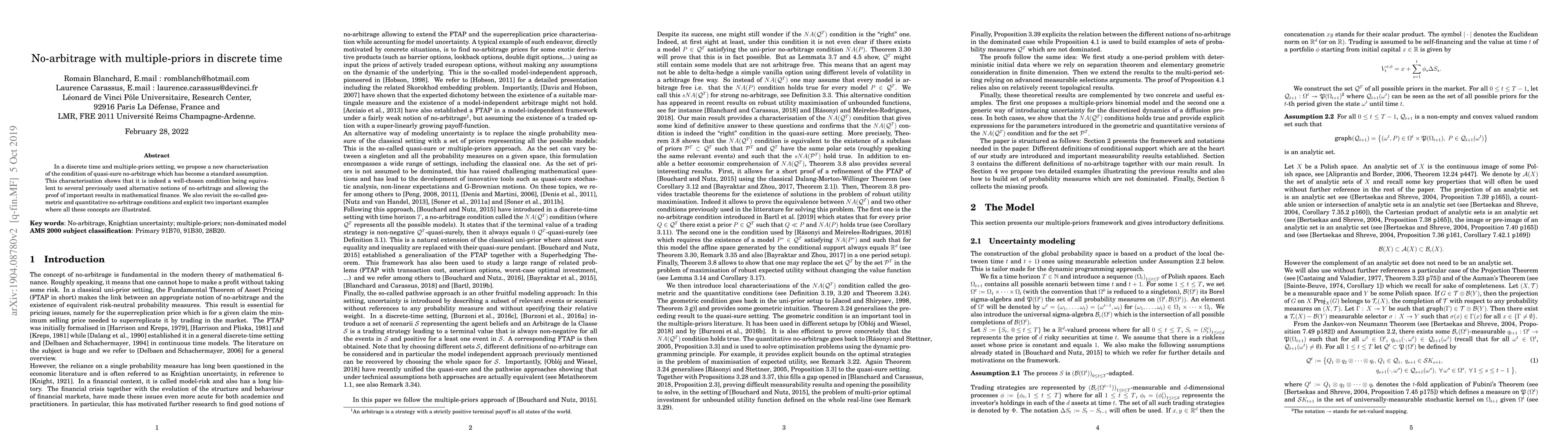

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)