Authors

Summary

In this paper, a general framework is developed for continuous-time financial market models defined from simple strategies through conditional topologies that avoid stochastic calculus and do not necessitate semimartingale models. We then compare the usual no-arbitrage conditions of the literature, e.g. the usual no-arbitrage conditions NFL, NFLVR and NUPBR and the recent AIP condition. With appropriate pseudo-distance topologies, we show that they hold in continuous time if and only if they hold in discrete time. Moreover, the super-hedging prices in continuous time coincide with the discrete-time super-hedging prices, even without any no-arbitrage condition.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

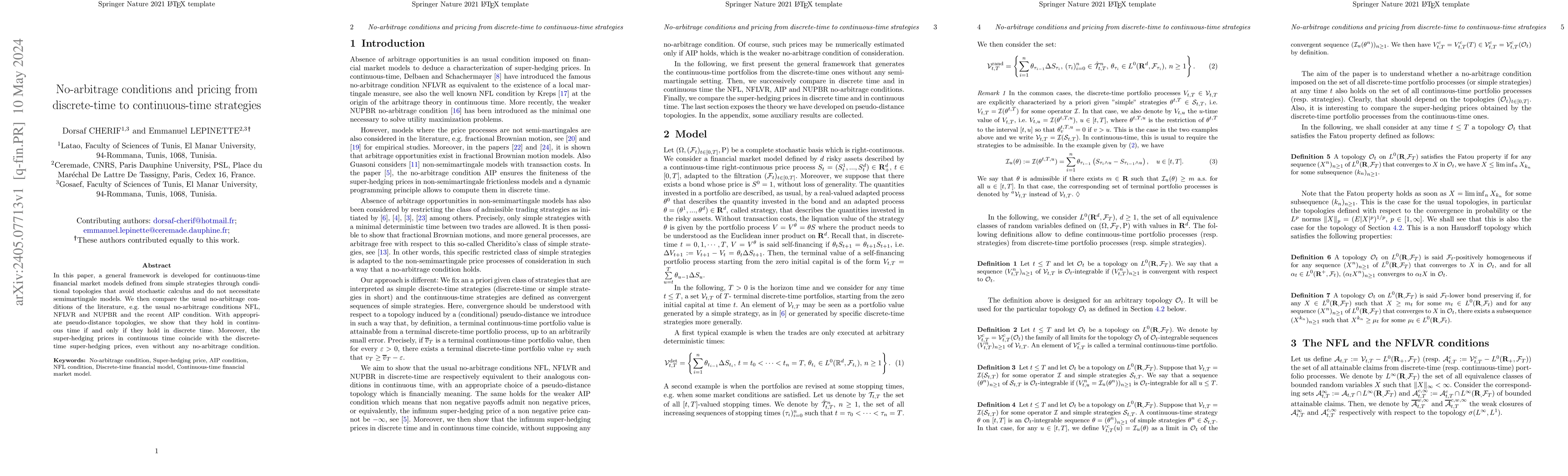

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)