Summary

This paper completes the two studies undertaken in \cite{aksamit/choulli/deng/jeanblanc2} and \cite{aksamit/choulli/deng/jeanblanc3}, where the authors quantify the impact of a random time on the No-Unbounded-Risk-with-Bounded-Profit concept (called NUPBR hereafter) when the stock price processes are quasi-left-continuous (do not jump on predictable stopping times). Herein, we focus on the NUPBR for semimartingales models that live on thin predictable sets only and the progressive enlargement with a random time. For this flow of information, we explain how far the NUPBR property is affected when one stops the model by an arbitrary random time or when one incorporates fully an honest time into the model. This also generalizes \cite{choulli/deng} to the case when the jump times are not ordered in anyway. Furthermore, for the current context, we show how to construct explicitly local martingale deflator under the bigger filtration from those of the smaller filtration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

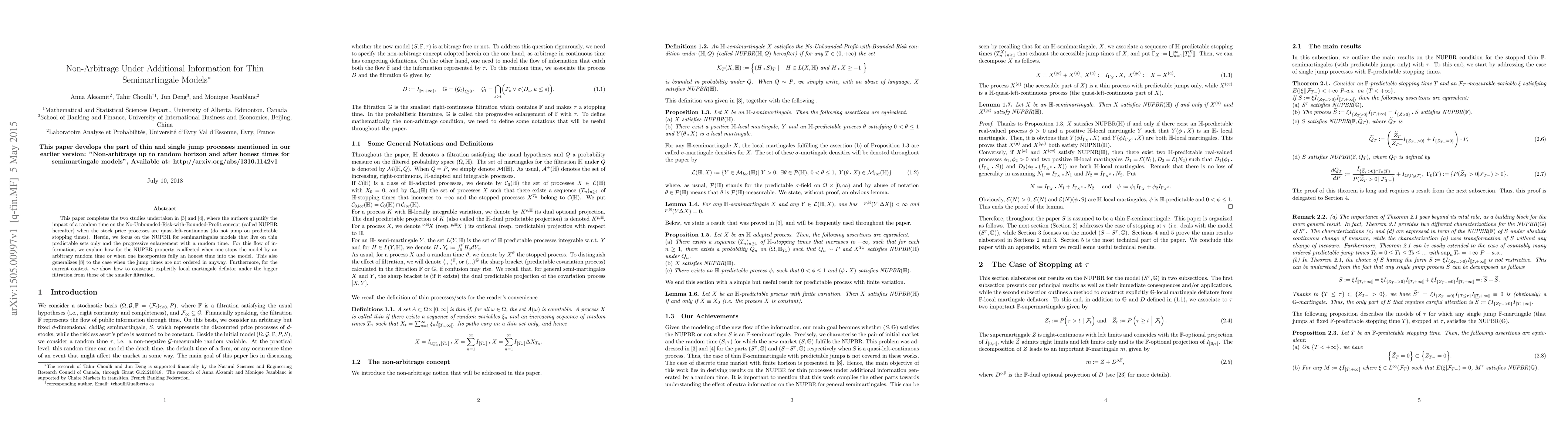

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)