Summary

This paper addresses the question of how an arbitrage-free semimartingale model is affected when stopped at a random horizon. We focus on No-Unbounded-Profit-with-Bounded-Risk (called NUPBR hereafter) concept, which is also known in the literature as the first kind of non-arbitrage. For this non-arbitrage notion, we obtain two principal results. The first result lies in describing the pairs of market model and random time for which the resulting stopped model fulfills NUPBR condition. The second main result characterises the random time models that preserve the NUPBR property after stopping for any market model. These results are elaborated in a very general market model, and we also pay attention to some particular and practical models. The analysis that drives these results is based on new stochastic developments in semimartingale theory with progressive enlargement. Furthermore, we construct explicit martingale densities (deflators) for some classes of local martingales when stopped at random time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

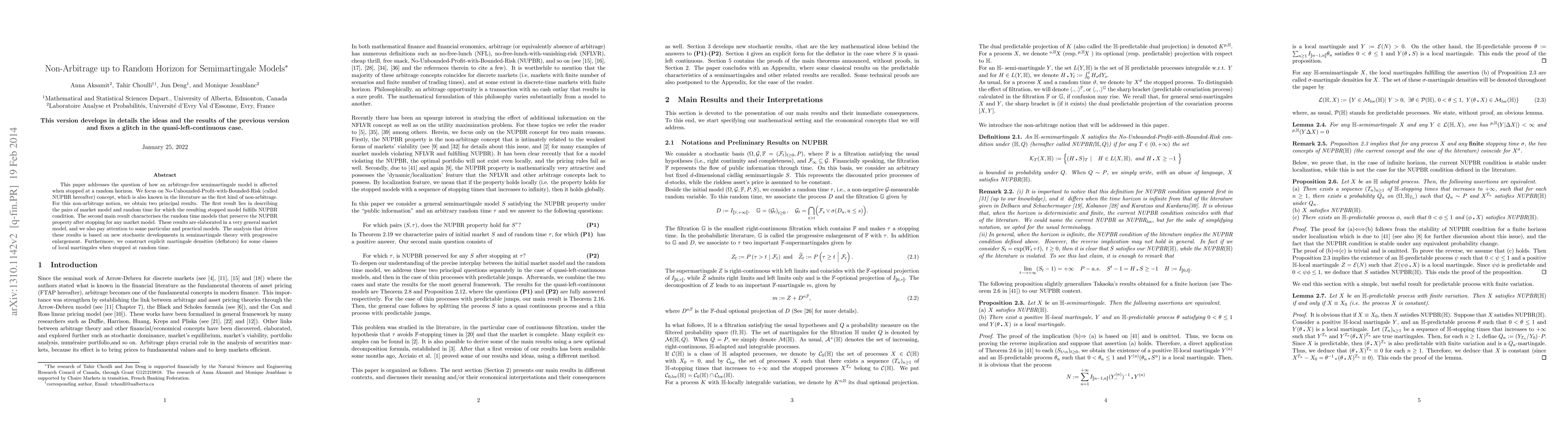

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)