Summary

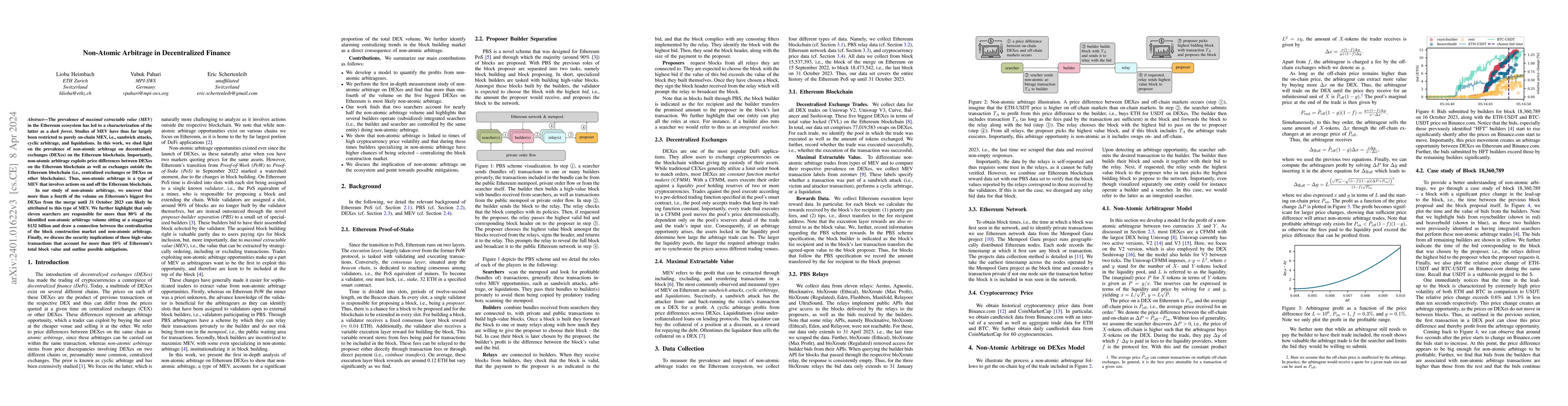

The prevalence of maximal extractable value (MEV) in the Ethereum ecosystem has led to a characterization of the latter as a dark forest. Studies of MEV have thus far largely been restricted to purely on-chain MEV, i.e., sandwich attacks, cyclic arbitrage, and liquidations. In this work, we shed light on the prevalence of non-atomic arbitrage on decentralized exchanges (DEXes) on the Ethereum blockchain. Importantly, non-atomic arbitrage exploits price differences between DEXes on the Ethereum blockchain as well as exchanges outside the Ethereum blockchain (i.e., centralized exchanges or DEXes on other blockchains). Thus, non-atomic arbitrage is a type of MEV that involves actions on and off the Ethereum blockchain. In our study of non-atomic arbitrage, we uncover that more than a fourth of the volume on Ethereum's biggest five DEXes from the merge until 31 October 2023 can likely be attributed to this type of MEV. We further highlight that only eleven searchers are responsible for more than 80% of the identified non-atomic arbitrage volume sitting at a staggering $132 billion and draw a connection between the centralization of the block construction market and non-atomic arbitrage. Finally, we discuss the security implications of these high-value transactions that account for more than 10% of Ethereum's total block value and outline possible mitigations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInsurance-Finance Arbitrage

Thorsten Schmidt, Philippe Artzner, Karl-Theodor Eisele

Cyclic Arbitrage in Decentralized Exchanges

Yan Chen, Ye Wang, Roger Wattenhofer et al.

Robust asymptotic insurance-finance arbitrage

Katharina Oberpriller, Thorsten Schmidt, Moritz Ritter

| Title | Authors | Year | Actions |

|---|

Comments (0)