Summary

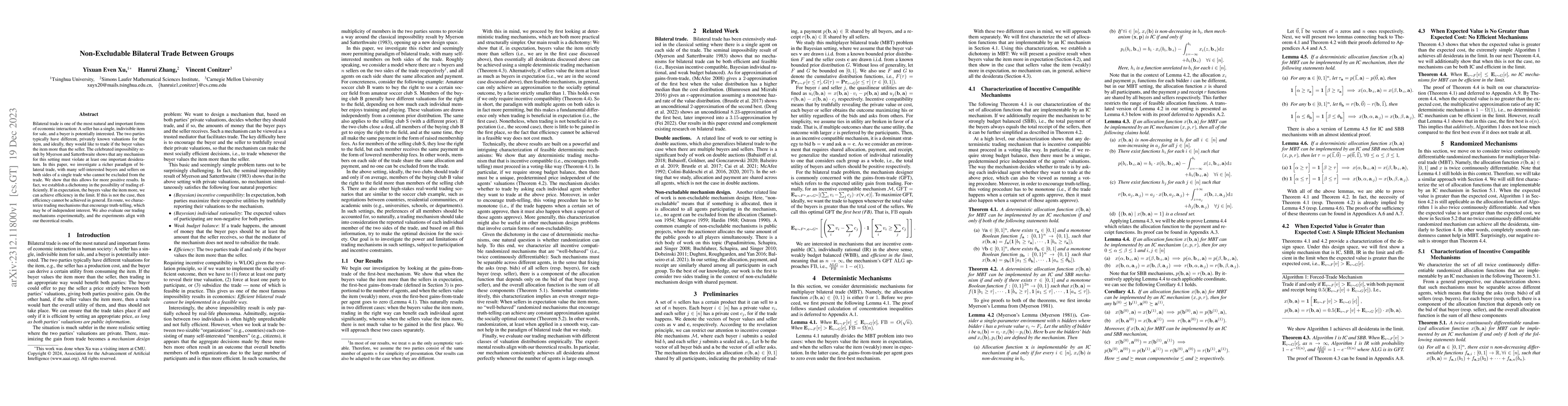

Bilateral trade is one of the most natural and important forms of economic interaction: A seller has a single, indivisible item for sale, and a buyer is potentially interested. The two parties typically have different, privately known valuations for the item, and ideally, they would like to trade if the buyer values the item more than the seller. The celebrated impossibility result by Myerson and Satterthwaite shows that any mechanism for this setting must violate at least one important desideratum. In this paper, we investigate a richer paradigm of bilateral trade, with many self-interested buyers and sellers on both sides of a single trade who cannot be excluded from the trade. We show that this allows for more positive results. In fact, we establish a dichotomy in the possibility of trading efficiently. If in expectation, the buyers value the item more, we can achieve efficiency in the limit. If this is not the case, then efficiency cannot be achieved in general. En route, we characterize trading mechanisms that encourage truth-telling, which may be of independent interest. We also evaluate our trading mechanisms experimentally, and the experiments align with our theoretical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Trade Flow Prediction with Bilateral Trade Provisions

Caiwen Ding, Jiahui Zhao, Dongjin Song et al.

Fair Online Bilateral Trade

François Bachoc, Tommaso Cesari, Roberto Colomboni et al.

No citations found for this paper.

Comments (0)