Summary

We investigate the presence of sign and size non-linearities in the impact of the European Central Bank\textquotesingle s Anti-Fragmentation Policy on non-ERM II, EU countries. After identifying three orthogonal monetary policy shock using the method of Fanelli and Marsi [2022], we then select an optimal specification and estimate both linear and non linear impulse response functions using local projections (Dufour and Renault [1998], Goncalves et al. [2021]). The choice of non-linear transformations to separate sign and size effects is based on Caravello and Martinez-Bruera [Working Paper, 2024]. Lastly we compare the linear model to the non-linear ones using a battery of Wald tests and find significant evidence of sign non-linearities in the international spillovers of ECB policy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

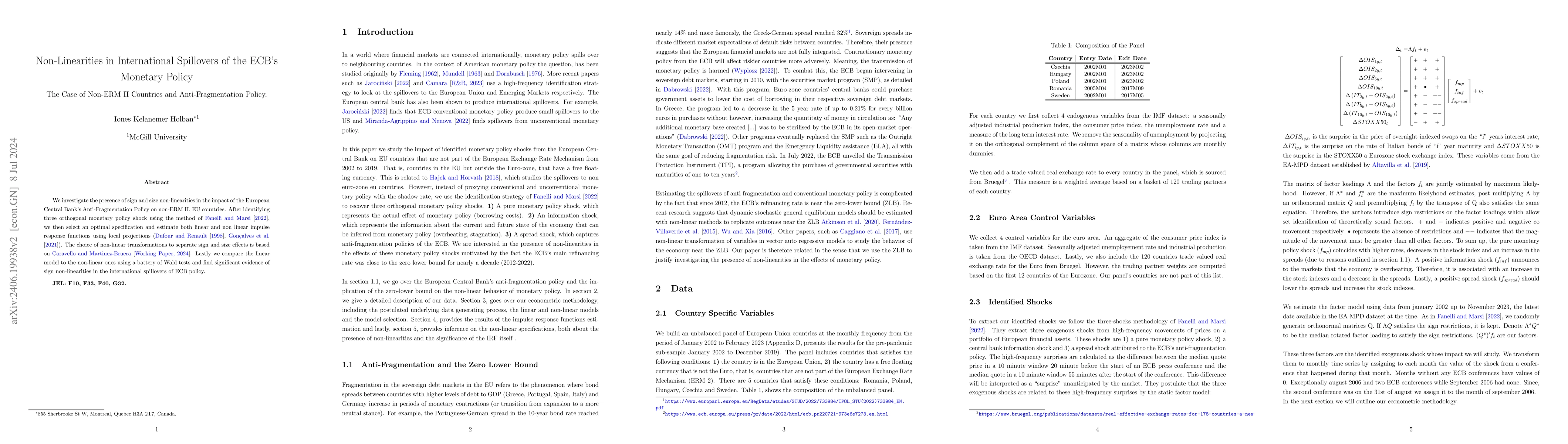

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Spillovers of ECB Interest Rates: Monetary Policy & Information Effects

Santiago Camara

No citations found for this paper.

Comments (0)