Authors

Summary

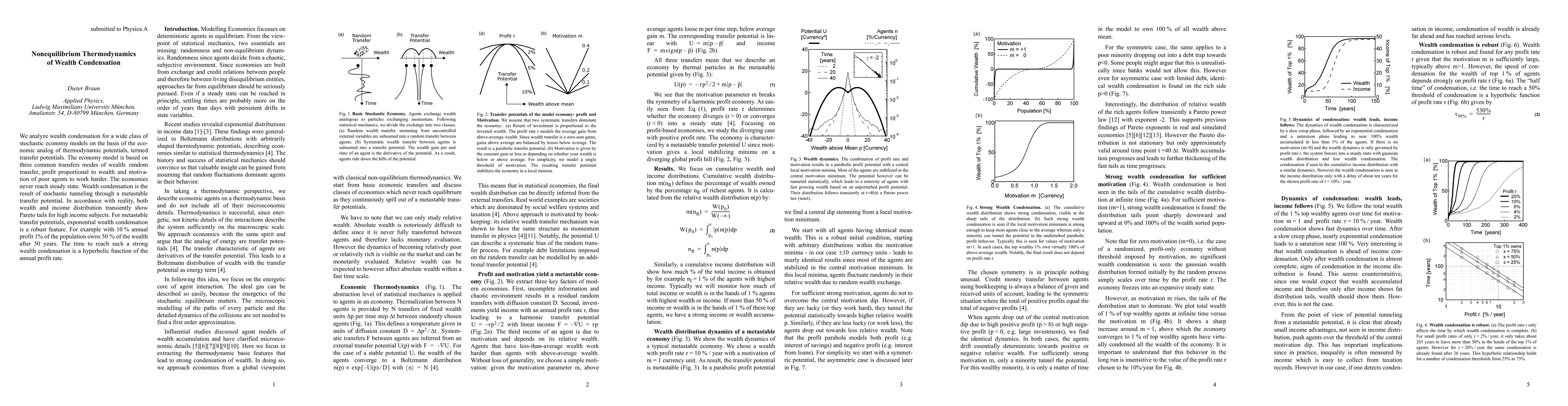

We analyze wealth condensation for a wide class of stochastic economy models on the basis of the economic analog of thermodynamic potentials, termed transfer potentials. The economy model is based on three common transfers modes of wealth: random transfer, profit proportional to wealth and motivation of poor agents to work harder. The economies never reach steady state. Wealth condensation is the result of stochastic tunneling through a metastable transfer potential. In accordance with reality, both wealth and income distribution transiently show Pareto tails for high income subjects. For metastable transfer potentials, exponential wealth condensation is a robust feature. For example with 10 % annual profit 1% of the population owns 50 % of the wealth after 50 years. The time to reach such a strong wealth condensation is a hyperbolic function of the annual profit rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWealth Condensation in Pareto Macro-Economies

G. Papp, M. A. Nowak, Z. Burda et al.

Local wealth condensation for yard-sale models with wealth-dependent biases

Christoph Börgers, Claude Greengard

| Title | Authors | Year | Actions |

|---|

Comments (0)