Summary

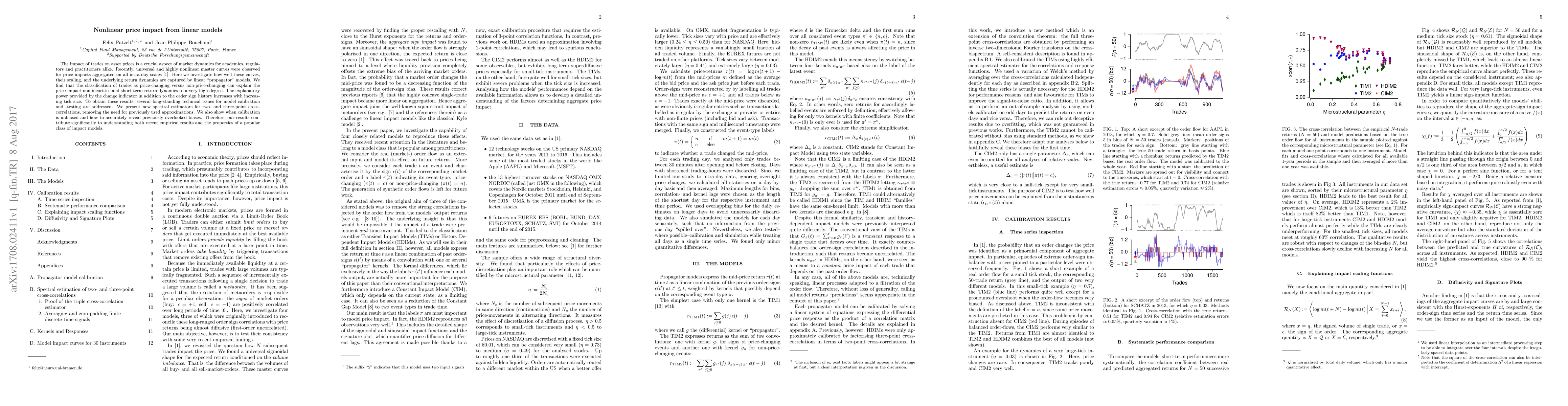

The impact of trades on asset prices is a crucial aspect of market dynamics for academics, regulators and practitioners alike. Recently, universal and highly nonlinear master curves were observed for price impacts aggregated on all intra-day scales [1]. Here we investigate how well these curves, their scaling, and the underlying return dynamics are captured by linear "propagator" models. We find that the classification of trades as price-changing versus non-price-changing can explain the price impact nonlinearities and short-term return dynamics to a very high degree. The explanatory power provided by the change indicator in addition to the order sign history increases with increasing tick size. To obtain these results, several long-standing technical issues for model calibration and -testing are addressed. We present new spectral estimators for two- and three-point cross-correlations, removing the need for previously used approximations. We also show when calibration is unbiased and how to accurately reveal previously overlooked biases. Therefore, our results contribute significantly to understanding both recent empirical results and the properties of a popular class of impact models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)