Authors

Summary

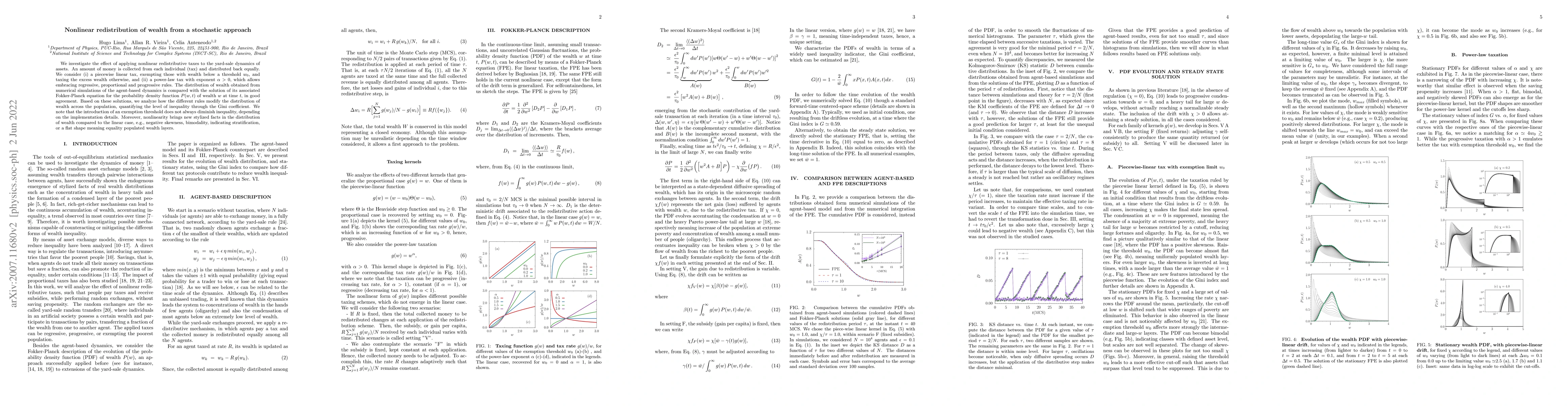

We investigate the effect of applying nonlinear redistributive taxes to the yard-sale dynamics of assets. An amount of money is collected from each individual (tax) and distributed back equally. We consider (i) a piecewise linear tax, exempting those with wealth below a threshold $w_0$, and taxing the excess wealth otherwise, and (ii) a power-law tax with exponent $\alpha>0$, which allows embracing regressive, proportional and progressive rules. The distribution of wealth obtained from numerical simulations of the agent-based dynamics is compared with the solution of its associated Fokker-Planck equation for the probability density function $P(w,t)$ of wealth $w$ at time $t$, in good agreement. Based on these solutions, we analyze how the different rules modify the distribution of wealth across the population, quantifying the level of inequality through the Gini coefficient. We note that the introduction of an exemption threshold does not always diminish inequality, depending on the implementation details. Moreover, nonlinearity brings new stylized facts in the distribution of wealth compared to the linear case, e.g., negative skewness, bimodality, indicating stratification, or a flat shape meaning equality populated wealth layers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWealth inequality and utility: Effect evaluation of redistribution and consumption morals using macro-econophysical coupled approach

Takeshi Kato, Mohammad Rezoanul Hoque

Effects of taxes, redistribution actions and fiscal evasion on wealth inequality: an agent-based model approach

Iago Nascimento Barros, Marcelo Lobato Martins

| Title | Authors | Year | Actions |

|---|

Comments (0)