Summary

We consider a nonparametric heteroscedastic time series regression model and suggest testing procedures to detect changes in the conditional variance function. The tests are based on a sequential marked empirical process and thus combine classical CUSUM tests with marked empirical process approaches known from goodness-of-fit testing. The tests are consistent against general alternatives of a change in the conditional variance function, a feature that classical CUSUM tests are lacking. We derive a simple limiting distribution and in the case of univariate covariates even obtain asymptotically distribution-free tests. We demonstrate the good performance of the tests in a simulation study and consider exchange rate data as a real data application.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

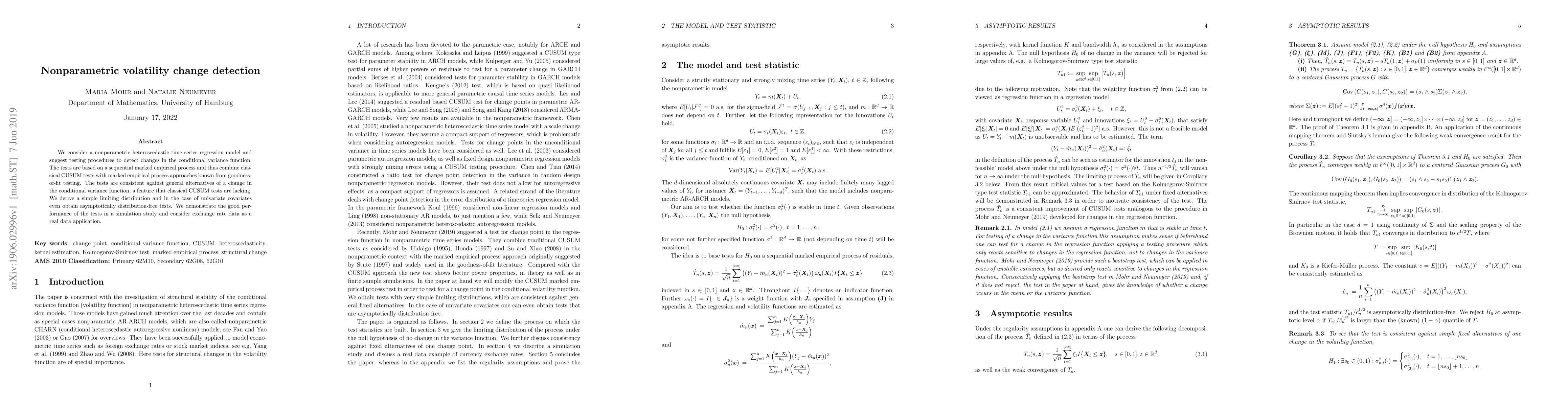

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Semiparametric Approach to the Detection of Change-points in Volatility Dynamics of Financial Data

Ashis Gangopadhyay, Huaiyu Hu

| Title | Authors | Year | Actions |

|---|

Comments (0)