Summary

This note shows that the cosine expansion based on the Vieta formula is equivalent to a discretization of the Parseval identity. We then evaluate the use of simple direct algorithms to compute the Shannon coefficients for the payoff. Finally, we explore the efficiency of a Filon quadrature instead of the Vieta formula for the coefficients related to the probability density function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

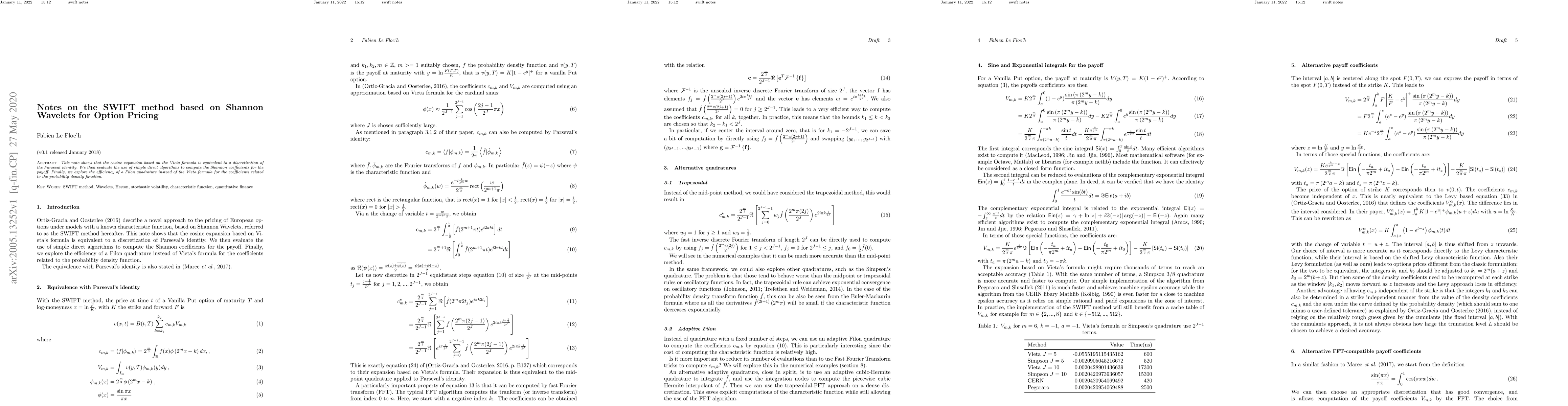

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNotes on the SWIFT method based on Shannon Wavelets for Option Pricing -- Revisited

Fabien Le Floc'h

On a Stable Method for Option Pricing: Discontinuous Petrov-Galerkin Method for Option Pricing and Sensitivity Analysis

Davood Damircheli

| Title | Authors | Year | Actions |

|---|

Comments (0)