Authors

Summary

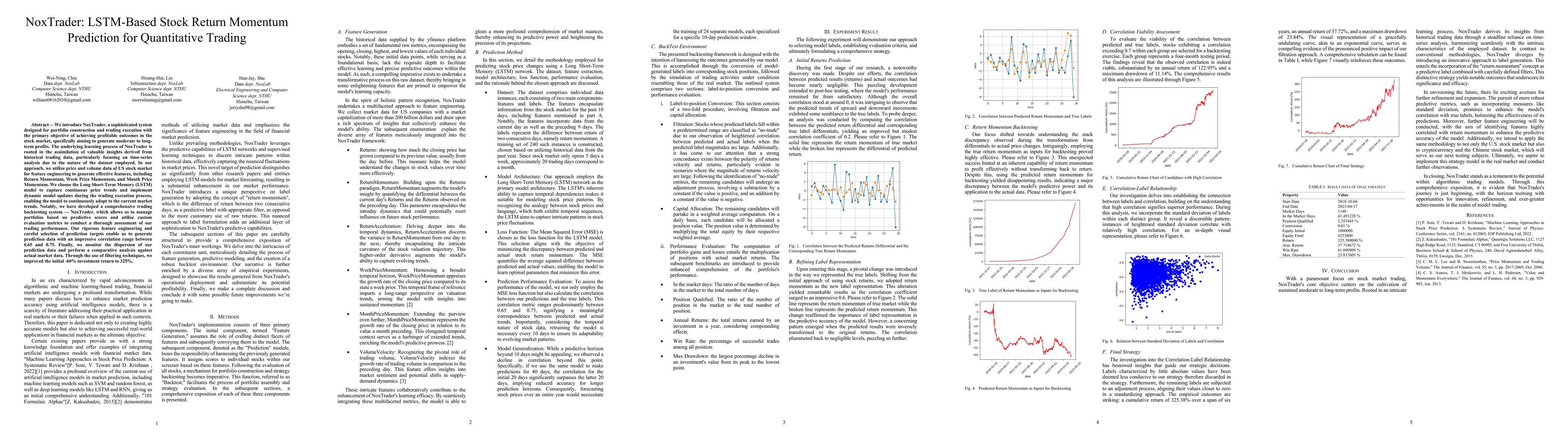

We introduce NoxTrader, a sophisticated system designed for portfolio construction and trading execution with the primary objective of achieving profitable outcomes in the stock market, specifically aiming to generate moderate to long-term profits. The underlying learning process of NoxTrader is rooted in the assimilation of valuable insights derived from historical trading data, particularly focusing on time-series analysis due to the nature of the dataset employed. In our approach, we utilize price and volume data of US stock market for feature engineering to generate effective features, including Return Momentum, Week Price Momentum, and Month Price Momentum. We choose the Long Short-Term Memory (LSTM)model to capture continuous price trends and implement dynamic model updates during the trading execution process, enabling the model to continuously adapt to the current market trends. Notably, we have developed a comprehensive trading backtesting system - NoxTrader, which allows us to manage portfolios based on predictive scores and utilize custom evaluation metrics to conduct a thorough assessment of our trading performance. Our rigorous feature engineering and careful selection of prediction targets enable us to generate prediction data with an impressive correlation range between 0.65 and 0.75. Finally, we monitor the dispersion of our prediction data and perform a comparative analysis against actual market data. Through the use of filtering techniques, we improved the initial -60% investment return to 325%.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNeuroevolution Neural Architecture Search for Evolving RNNs in Stock Return Prediction and Portfolio Trading

Hao Zhang, Travis Desell, Zimeng Lyu et al.

Attention-based CNN-LSTM and XGBoost hybrid model for stock prediction

Jian Wu, Yang Hu, Zhuangwei Shi et al.

BERT-based Financial Sentiment Index and LSTM-based Stock Return Predictability

Qi Wu, Xin Huang, Yabo Xu et al.

No citations found for this paper.

Comments (0)