Summary

This paper performs the numerical analysis and the computation of a Spread option in a market with imperfect liquidity. The number of shares traded in the stock market has a direct impact on the stock's price. Thus, we consider a full-feedback model in which price impact is fully incorporated into the model. The price of a Spread option is characterize by a nonlinear partial differential equation. This is reduced to linear equations by asymptotic expansions. The Peaceman-Rachford scheme as an alternating direction implicit method is employed to solve the linear equations numerically. We discuss the stability and the convergence of the numerical scheme. Illustrative examples are included to demonstrate the validity and applicability of the presented method. Finally we provide a numerical analysis of the illiquidity effect in replicating an European Spread option; compared to the Black-Scholes case, a trader generally buys more stock to replicate this option.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

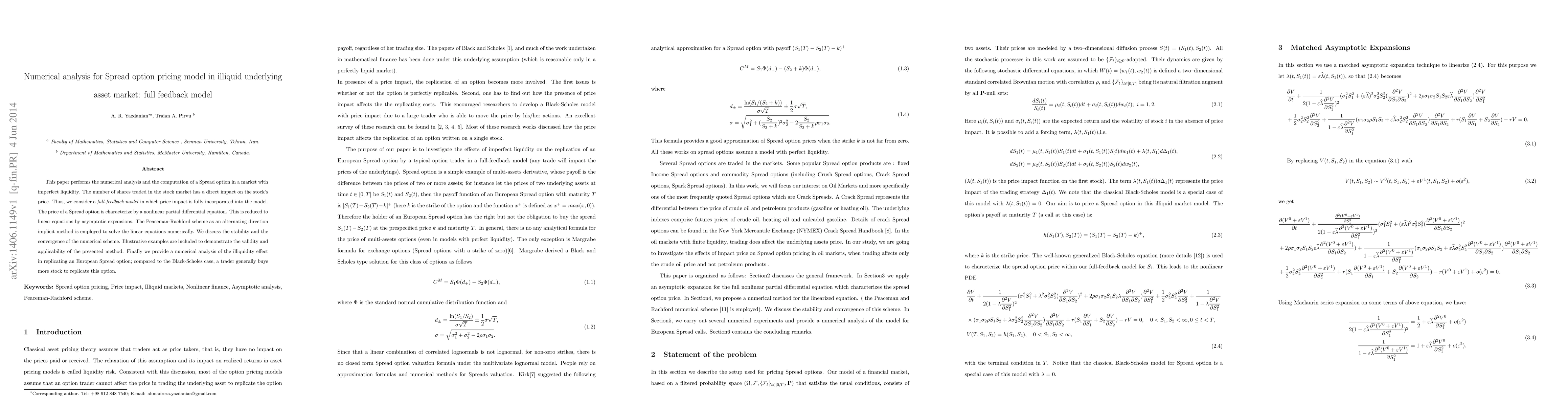

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)