Summary

We introduce a multivariate diffusion model that is able to price derivative securities featuring multiple underlying assets. Each asset volatility smile is modeled according to a density-mixture dynamical model while the same property holds for the multivariate process of all assets, whose density is a mixture of multivariate basic densities. This allows to reconcile single name and index/basket volatility smiles in a consistent framework. Our approach could be dubbed a multidimensional local volatility approach with vector-state dependent diffusion matrix. The model is quite tractable, leading to a complete market and not requiring Fourier techniques for calibration and dependence measures, contrary to multivariate stochastic volatility models such as Wishart. We prove existence and uniqueness of solutions for the model stochastic differential equations, provide formulas for a number of basket options, and analyze the dependence structure of the model in detail by deriving a number of results on covariances, its copula function and rank correlation measures and volatilities-assets correlations. A comparison with sampling simply-correlated suitably discretized one-dimensional mixture dynamical paths is made, both in terms of option pricing and of dependence, and first order expansion relationships between the two models' local covariances are derived. We also show existence of a multivariate uncertain volatility model of which our multivariate local volatilities model is a Markovian projection, highlighting that the projected model is smoother and avoids a number of drawbacks of the uncertain volatility version. We also show a consistency result where the Markovian projection of a geometric basket in the multivariate model is a univariate mixture dynamics model. A few numerical examples on basket and spread options pricing conclude the paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

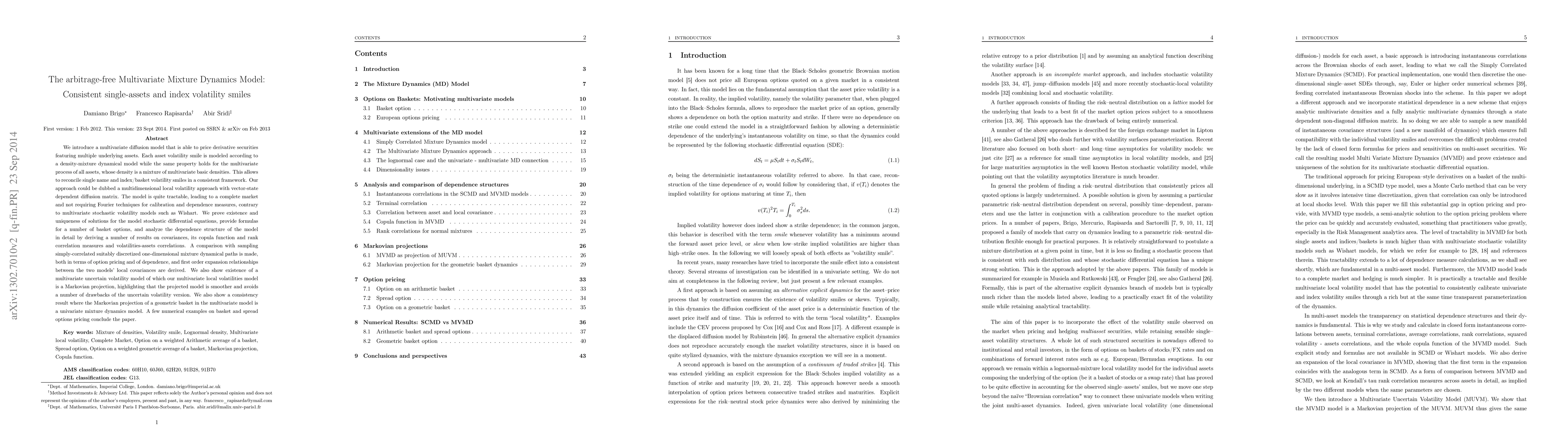

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)