Summary

This paper develops numerical methods for finding optimal dividend pay-out and reinsurance policies. A generalized singular control formulation of surplus and discounted payoff function are introduced, where the surplus is modeled by a regime-switching process subject to both regular and singular controls. To approximate the value function and optimal controls, Markov chain approximation techniques are used to construct a discrete-time controlled Markov chain with two components. The proofs of the convergence of the approximation sequence to the surplus process and the value function are given. Examples of proportional and excess-of-loss reinsurance are presented to illustrate the applicability of the numerical methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

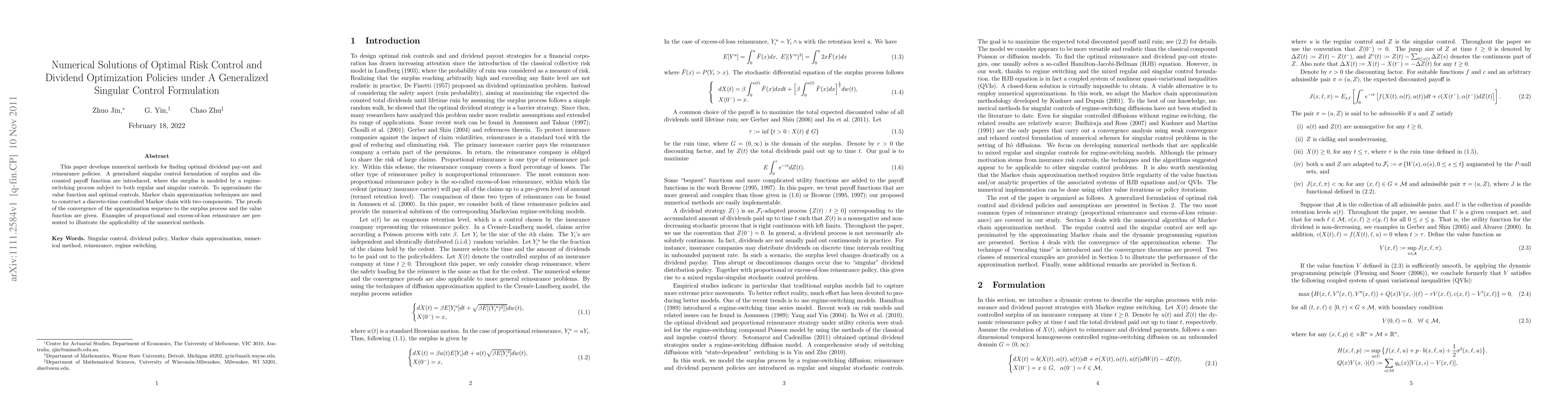

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Risk Policies and Periodic Dividend Strategies for an Insurance Company

Harold A. Moreno-Franco, Mark Kelbert, Nikolai P. Pogorelov

| Title | Authors | Year | Actions |

|---|

Comments (0)