Summary

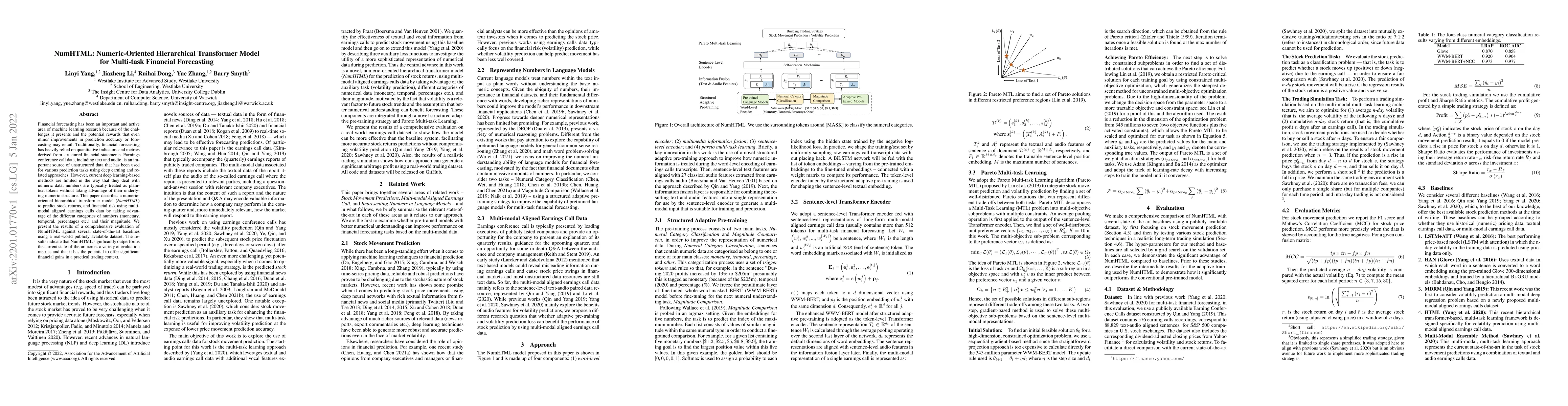

Financial forecasting has been an important and active area of machine learning research because of the challenges it presents and the potential rewards that even minor improvements in prediction accuracy or forecasting may entail. Traditionally, financial forecasting has heavily relied on quantitative indicators and metrics derived from structured financial statements. Earnings conference call data, including text and audio, is an important source of unstructured data that has been used for various prediction tasks using deep earning and related approaches. However, current deep learning-based methods are limited in the way that they deal with numeric data; numbers are typically treated as plain-text tokens without taking advantage of their underlying numeric structure. This paper describes a numeric-oriented hierarchical transformer model to predict stock returns, and financial risk using multi-modal aligned earnings calls data by taking advantage of the different categories of numbers (monetary, temporal, percentages etc.) and their magnitude. We present the results of a comprehensive evaluation of NumHTML against several state-of-the-art baselines using a real-world publicly available dataset. The results indicate that NumHTML significantly outperforms the current state-of-the-art across a variety of evaluation metrics and that it has the potential to offer significant financial gains in a practical trading context.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research used a numeric-oriented hierarchical transformer model to predict stock returns and financial risk from multi-modal aligned earnings calls data.

Key Results

- NumHTML significantly outperforms state-of-the-art baselines across various evaluation metrics

- Main finding: the model takes advantage of different categories of numbers (monetary, temporal, percentages etc.) and their magnitude to improve forecasting accuracy

- The results indicate that NumHTML has the potential to offer significant financial gains in a practical trading context

Significance

This research is important because it addresses the limitations of current deep learning-based methods for dealing with numeric data in financial forecasting.

Technical Contribution

The development of a numeric-oriented hierarchical transformer model that can effectively leverage the underlying structure of numbers to improve financial forecasting accuracy.

Novelty

NumHTML is novel because it addresses the limitations of current deep learning-based methods for dealing with numeric data in financial forecasting and offers a new approach to leveraging unstructured data from earnings calls

Limitations

- Current deep learning-based methods treat numbers as plain-text tokens without leveraging their underlying numeric structure

- The use of unstructured data from earnings calls can be challenging and may require additional processing steps

Future Work

- Further exploration of the potential applications of NumHTML in other areas of finance and economics

- Development of more advanced techniques for handling large amounts of unstructured data from earnings calls

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModality-aware Transformer for Financial Time series Forecasting

Xuan-Hong Dang, Yousaf Shah, Petros Zerfos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)