Authors

Summary

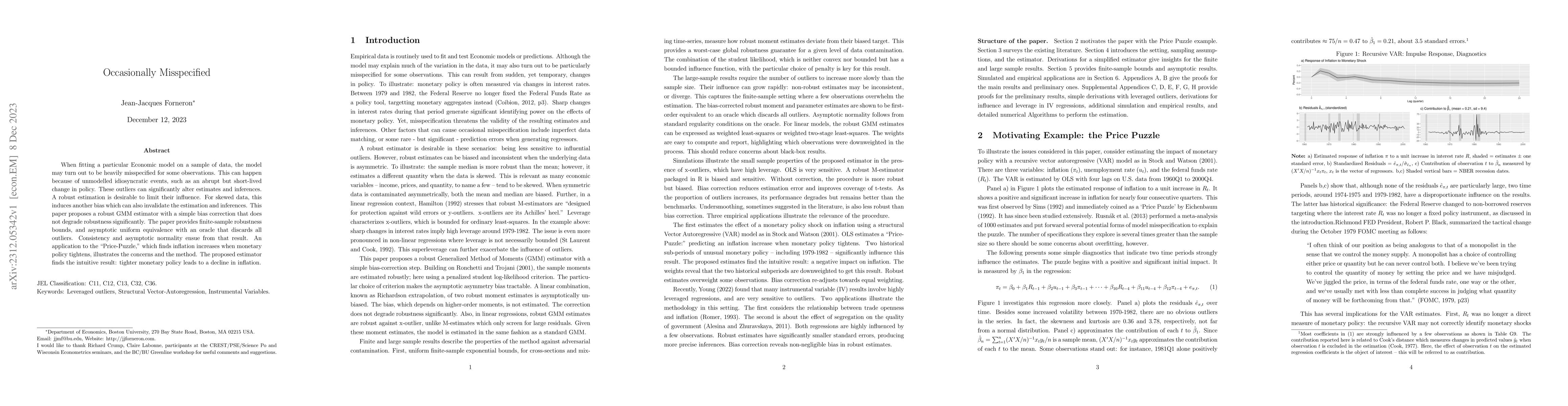

When fitting a particular Economic model on a sample of data, the model may turn out to be heavily misspecified for some observations. This can happen because of unmodelled idiosyncratic events, such as an abrupt but short-lived change in policy. These outliers can significantly alter estimates and inferences. A robust estimation is desirable to limit their influence. For skewed data, this induces another bias which can also invalidate the estimation and inferences. This paper proposes a robust GMM estimator with a simple bias correction that does not degrade robustness significantly. The paper provides finite-sample robustness bounds, and asymptotic uniform equivalence with an oracle that discards all outliers. Consistency and asymptotic normality ensue from that result. An application to the "Price-Puzzle," which finds inflation increases when monetary policy tightens, illustrates the concerns and the method. The proposed estimator finds the intuitive result: tighter monetary policy leads to a decline in inflation.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper proposes a robust GMM estimator with a simple bias correction for handling misspecification and outliers in economic models, providing finite-sample robustness bounds and asymptotic uniform equivalence with an oracle that discards outliers.

Key Results

- The proposed estimator maintains consistency and asymptotic normality.

- The method effectively corrects bias without significantly degrading robustness.

- An application to the 'Price-Puzzle' demonstrates that tighter monetary policy leads to a decline in inflation, contrary to previous findings that suggested an increase.

- The robust estimator outperforms standard IV estimates in precision, especially when data is skewed.

- The paper illustrates the sensitivity of standard IV regression to a few observations and the utility of robust estimation techniques.

Significance

This research is significant as it addresses the issue of misspecified models and outlier sensitivity in economic modeling, offering a robust estimation technique that provides transparent and interpretable results, which is crucial for reliable empirical findings.

Technical Contribution

The paper introduces a novel bias-corrected robust GMM estimator that ensures finite-sample robustness and asymptotic uniform equivalence, providing a practical solution to the problem of misspecified models and outlier influence in economic data.

Novelty

The novelty of this work lies in its simple yet effective bias correction for robust GMM estimation, which does not compromise robustness, and its application to real-world economic puzzles like the 'Price-Puzzle', offering insights that contradict previous findings.

Limitations

- The method assumes a specific model structure and may not generalize to all types of economic models.

- The paper does not extensively explore the computational complexity of the proposed estimator.

Future Work

- Further investigation into the computational efficiency of the proposed estimator for larger datasets.

- Exploration of the method's applicability to other areas of econometrics beyond the examples provided.

- Testing the robustness of the estimator under more diverse and complex misspecification scenarios.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersStationarity with Occasionally Binding Constraints

James A. Duffy, Sophocles Mavroeidis, Sam Wycherley

Cointegration with Occasionally Binding Constraints

James A. Duffy, Sophocles Mavroeidis, Sam Wycherley

No citations found for this paper.

Comments (0)