Summary

The paper proposes a different method of solving a simplified version of the Black-Scholes equation. This paper will discuss the importance of the Black-Scholes equation and its applications in finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

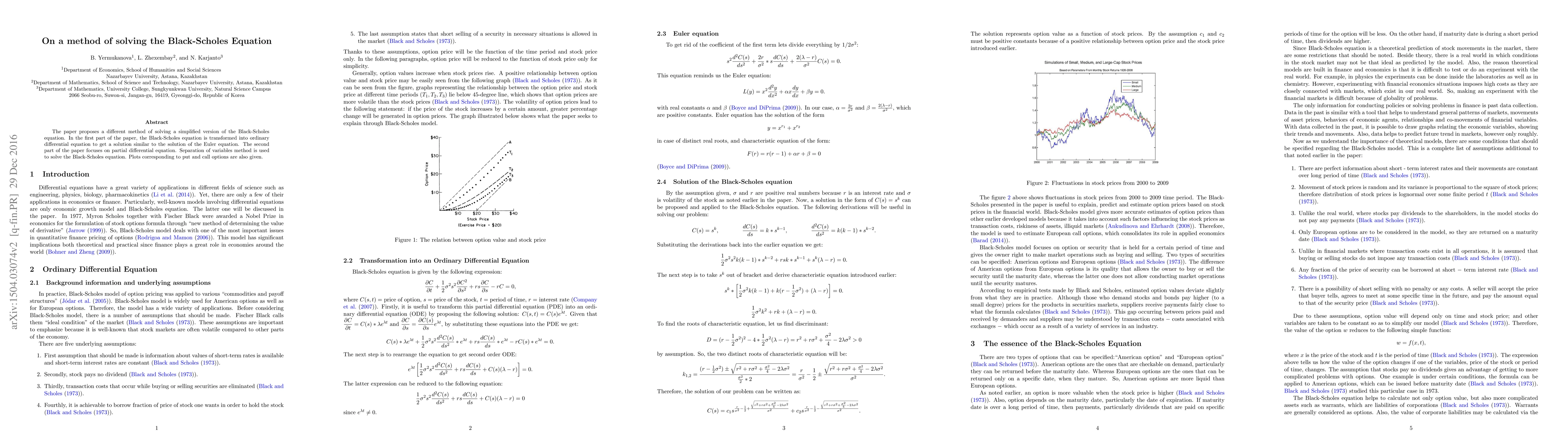

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)