Summary

Black-Scholes equation as one of the most celebrated mathematical models has an explicit analytical solution known as the Black-Scholes formula. Later variations of the equation, such as fractional or nonlinear Black-Scholes equations, do not have a closed form expression for the corresponding formula. In that case, one will need asymptotic expansions, including homotopy perturbation method, to give an approximate analytical solution. However, the solution is non-smooth at a special point. We modify the method by {first} performing variable transformations that push the point to infinity. As a test bed, we apply the method to the solvable Black-Scholes equation, where excellent agreement with the exact solution is obtained. We also extend our study to multi-asset basket and quanto options by reducing the cases to single-asset ones. Additionally we provide a novel analytical solution of the single-asset quanto option that is simple and different from the existing expression.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

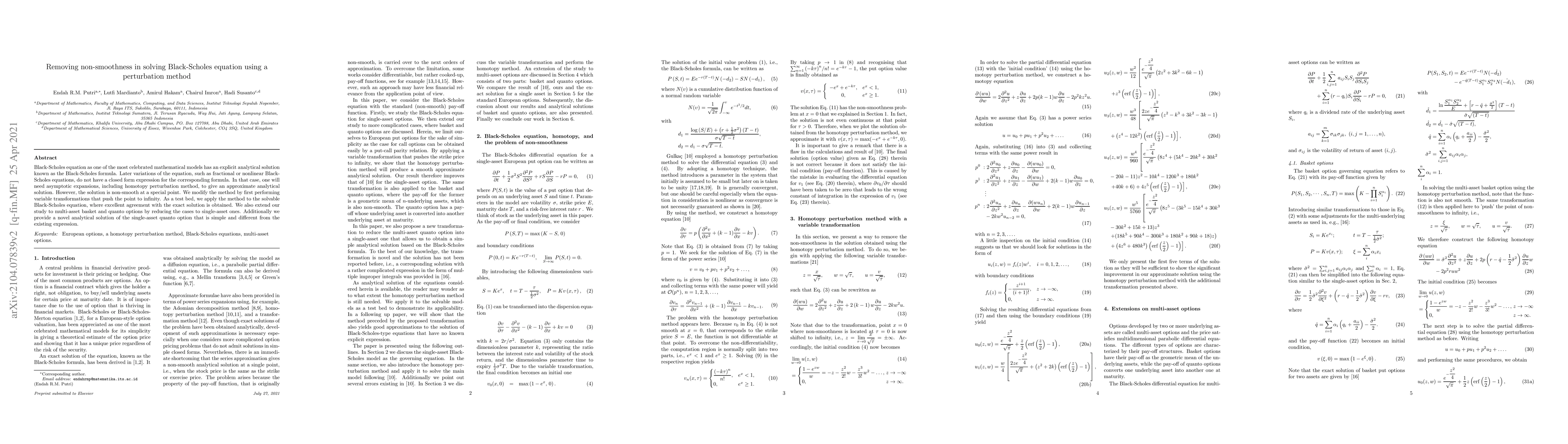

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)