Authors

Summary

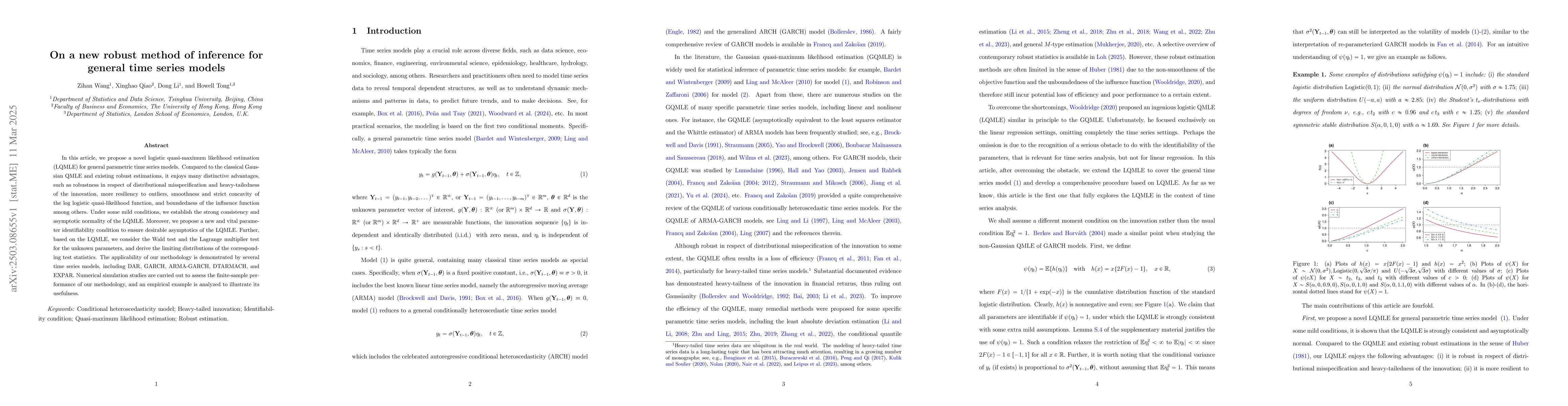

In this article, we propose a novel logistic quasi-maximum likelihood estimation (LQMLE) for general parametric time series models. Compared to the classical Gaussian QMLE and existing robust estimations, it enjoys many distinctive advantages, such as robustness in respect of distributional misspecification and heavy-tailedness of the innovation, more resiliency to outliers, smoothness and strict concavity of the log logistic quasi-likelihood function, and boundedness of the influence function among others. Under some mild conditions, we establish the strong consistency and asymptotic normality of the LQMLE. Moreover, we propose a new and vital parameter identifiability condition to ensure desirable asymptotics of the LQMLE. Further, based on the LQMLE, we consider the Wald test and the Lagrange multiplier test for the unknown parameters, and derive the limiting distributions of the corresponding test statistics. The applicability of our methodology is demonstrated by several time series models, including DAR, GARCH, ARMA-GARCH, DTARMACH, and EXPAR. Numerical simulation studies are carried out to assess the finite-sample performance of our methodology, and an empirical example is analyzed to illustrate its usefulness.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research proposes a novel logistic quasi-maximum likelihood estimation (LQMLE) for general parametric time series models, offering advantages such as robustness to distributional misspecification, heavy-tailedness, and outliers, alongside smoothness and strict concavity of the log logistic quasi-likelihood function.

Key Results

- LQMLE is established to be strongly consistent and asymptotically normal under mild conditions.

- A new parameter identifiability condition is proposed to ensure desirable asymptotics of the LQMLE.

- Wald test and Lagrange multiplier test statistics are derived with limiting distributions based on LQMLE.

- The applicability of the methodology is demonstrated through various time series models including DAR, GARCH, ARMA-GARCH, DTARMACH, and EXPAR.

- Numerical simulations assess the finite-sample performance, and an empirical example illustrates its usefulness.

Significance

This research is significant as it introduces a robust estimation method for time series models that performs well even under heavy-tailed distributions and distributional misspecifications, which are common in real-world data. The method's resilience to outliers and its theoretical guarantees of consistency and asymptotic normality make it valuable for practical applications in finance, economics, and other fields dealing with time series analysis.

Technical Contribution

The paper presents a logistic quasi-maximum likelihood estimation (LQMLE) method for general time series models, providing conditions for its strong consistency and asymptotic normality, and deriving limiting distributions for test statistics based on LQMLE.

Novelty

The proposed LQMLE method offers distinct advantages over classical Gaussian QMLE and existing robust estimations, including robustness to heavy-tailedness, resilience to outliers, and smooth log logistic quasi-likelihood function, making it a novel contribution to time series analysis.

Limitations

- The study focuses on univariate parametric time series models, leaving multivariate models for future work.

- The method assumes conditional symmetry of the innovation, which may not always hold in practice.

Future Work

- Explore extensions to multivariate time series models.

- Investigate methods to handle asymmetric innovations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime Series Clustering with General State Space Models via Stochastic Variational Inference

Ryoichi Ishizuka, Takashi Imai, Kaoru Kawamoto

No citations found for this paper.

Comments (0)