Summary

We consider the fundamental theorem of asset pricing (FTAP) and hedging prices of options under non-dominated model uncertainty and portfolio constrains in discrete time. We first show that no arbitrage holds if and only if there exists some family of probability measures such that any admissible portfolio value process is a local super-martingale under these measures. We also get the non-dominated optional decomposition with constraints. From this decomposition, we get duality of the super-hedging prices of European options, as well as the sub- and super-hedging prices of American options. Finally, we get the FTAP and duality of super-hedging prices in a market where stocks are traded dynamically and options are traded statically.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

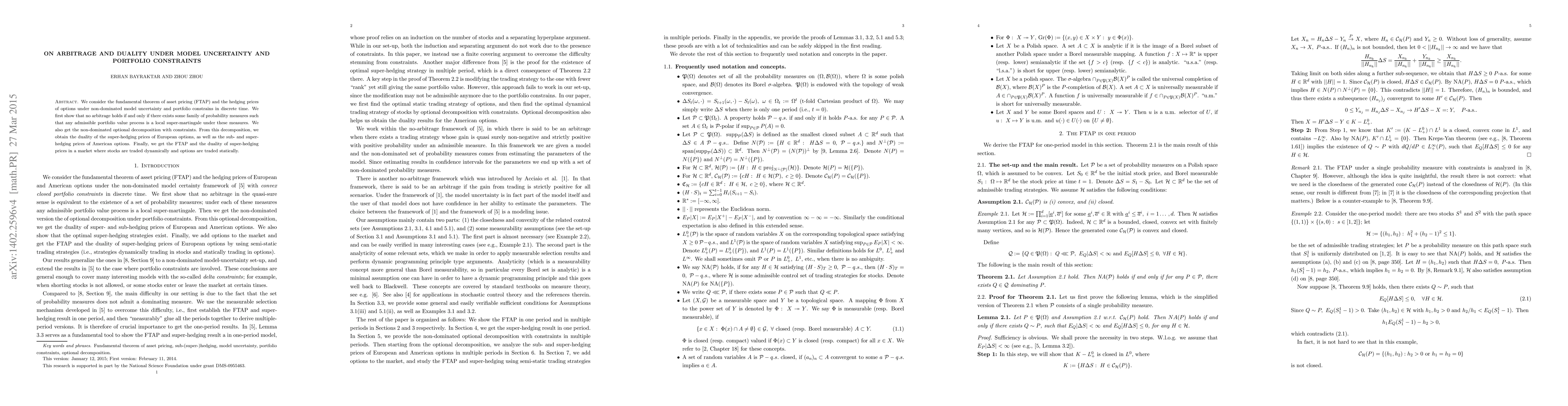

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnergy Storage Arbitrage Under Price Uncertainty: Market Risks and Opportunities

James Anderson, Bolun Xu, Yiqian Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)