Summary

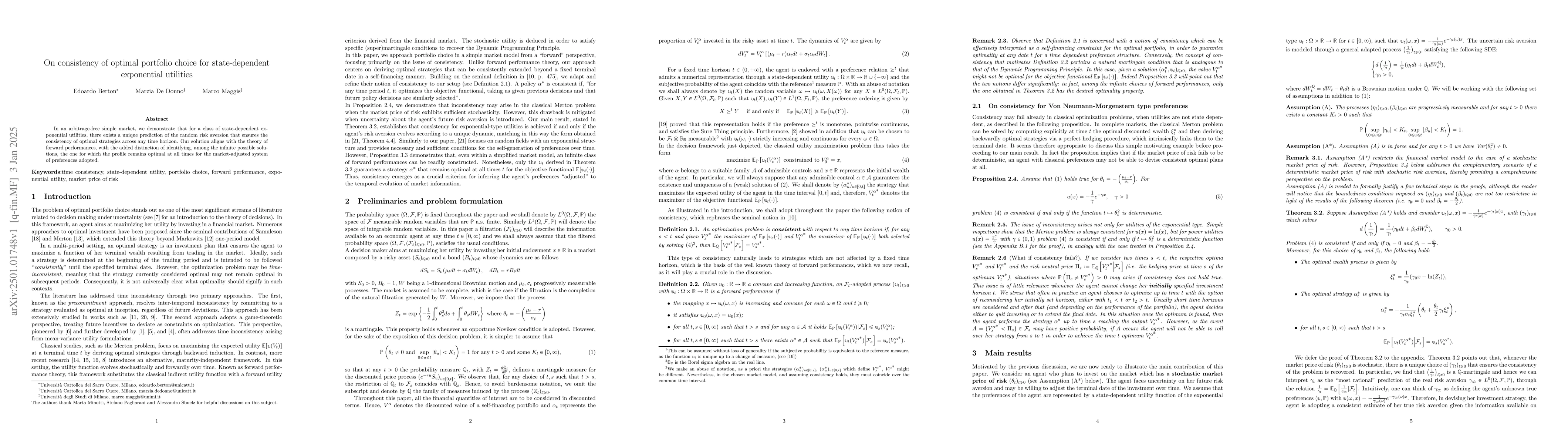

In an arbitrage-free simple market, we demonstrate that for a class of state-dependent exponential utilities, there exists a unique prediction of the random risk aversion that ensures the consistency of optimal strategies across any time horizon. Our solution aligns with the theory of forward performances, with the added distinction of identifying, among the infinite possible solutions, the one for which the profile remains optimal at all times for the market-adjusted system of preferences adopted.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEquilibrium portfolio selection under beliefs-dependent utilities

Xiaochen Chen, Zongxia Liang, Guohui Guan

Wage Rigidity and Retirement in Optimal Portfolio Choice

Margherita Zanella, Fausto Gozzi, Sara Biagini et al.

A Unified Formula of the Optimal Portfolio for Piecewise Hyperbolic Absolute Risk Aversion Utilities

Yang Liu, Ming Ma, Zongxia Liang et al.

No citations found for this paper.

Comments (0)